Commentary

Value Equity 3Q 2023

Markets Review

Sources: CAPS CompositeHubTM, Bloomberg

Past performance is not indicative of future results. Aristotle Value Equity Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Capital Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

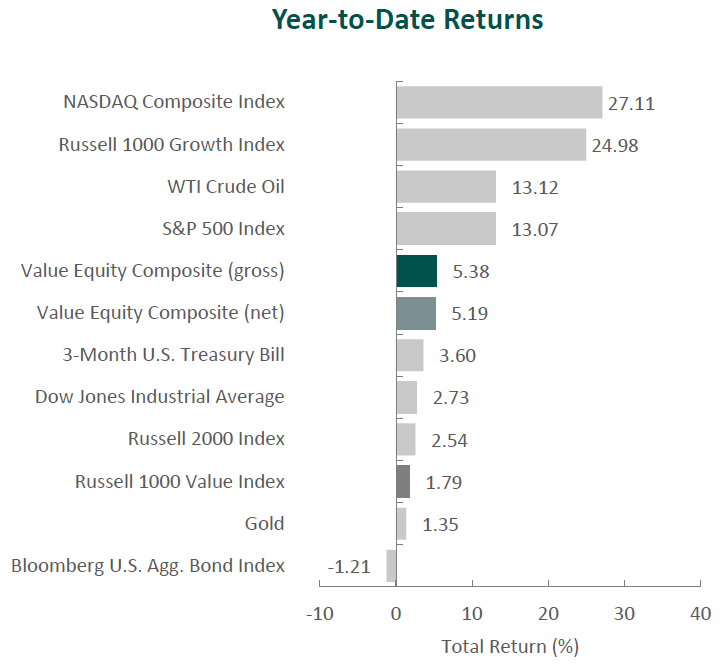

After three consecutive positive quarters, the U.S. equity market pulled back, as the S&P 500 Index declined 3.27% during the quarter. Concurrently, the Bloomberg U.S. Aggregate Bond Index also fell, dropping 3.23% for the quarter. In terms of style, the Russell 1000 Growth Index slightly outperformed its value counterpart by 0.03%.

Declines were broad-based, as ten out of the eleven sectors within the Russell 1000 Value Index finished lower. Consumer Discretionary, Utilities and Real Estate were the worst-performing sectors. Meanwhile, Energy was the only sector in the green, and Financials and Information Technology declined the least.

Economic growth in the U.S. remained steady, as data released during the quarter showed real GDP increased at an annual rate of 2.1%. The increase was driven by higher levels of consumer and government spending, as well as nonresidential fixed investment. The labor market remained tight during the period, with a 3.8% unemployment rate in August, while average hourly earnings for all employees increased by 4.3% year-over-year.

There was an uptick in inflation reported during the quarter, as annualized CPI increased from 3.0% in June to 3.7% in August. In addition, oil hit its highest level of the year, with both WTI and Brent eclipsing $90 a barrel. Given the concerns about rebounding inflation, 10-year and 30-year Treasury yields spiked to their highest marks since 2007 and 2011, finishing the quarter at 4.59% and 4.73%, respectively. However, the broader trend of disinflation continues, as the 3.7% August CPI figure is still less than half the 8.3% increase the Index experienced the year prior.

After raising its benchmark federal funds rate to a range of 5.25% to 5.50% in July, the Federal Reserve (Fed) held interest rates steady in September, citing a solid pace of expanding economic activity, a slightly softer—yet still strong—labor market and tighter credit conditions. The Fed indicated that it would continue to monitor cumulative monetary policy, the lagged effects of policy decisions, and economic and financial developments when determining the extent of additional rate increases.

On the corporate earnings front, S&P 500 companies reported a 4.1% decline in earnings, the third straight quarter that saw a year-over-year decrease. Despite the drop, fewer companies discussed “recession” and “inflation” during the reporting period. Furthermore, aggregate earnings estimates for the third quarter increased by 0.4% (above the 10-year average of -3.4%), the first increase in nearly two years.

Performance and Attribution Summary

For the third quarter of 2023, Aristotle Capital’s Value Equity Composite posted a total return of -2.99% gross of fees (-3.05% net of fees), outperforming the -3.16% return of the Russell 1000 Value Index and the -3.27% return of the S&P 500 Index. Please refer to the table for detailed performance.

| Performance (%) | 3Q23 | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|---|

| Value Equity Composite (gross) | -2.99 | 5.38 | 16.52 | 9.47 | 8.86 | 11.25 |

| Value Equity Composite (net) | -3.05 | 5.19 | 16.23 | 9.19 | 8.56 | 10.91 |

| Russell 1000 Value Index | -3.16 | 1.79 | 14.44 | 11.05 | 6.22 | 8.44 |

| S&P 500 Index | -3.27 | 13.07 | 21.62 | 10.15 | 9.91 | 11.91 |

Source: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income.

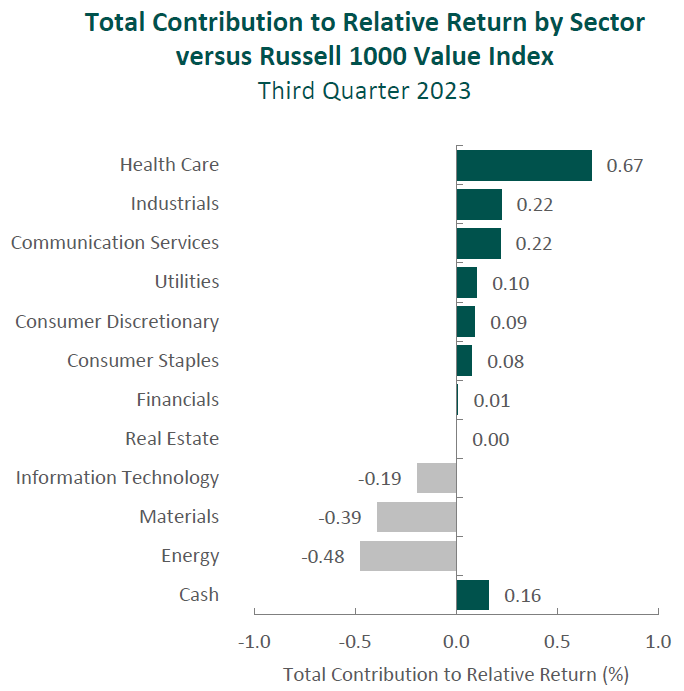

The portfolio’s outperformance relative to the Russell 1000 Value Index in the third quarter can be attributed to security selection, while allocation effects had a negative impact. Security selection in Health Care, Consumer Discretionary and Communication Services contributed the most to relative performance. Conversely, an underweight in Energy and security selection in Materials and Information Technology detracted. (Relative weights are the result of bottom-up security selection.)

Contributors and Detractors for 3Q 2023

| Relative Contributors | Relative Detractors |

|---|---|

| Amgen | Xylem |

| Phillips 66 | Microchip Technology |

| Blackstone | Corteva |

| Mitsubishi UFJ Financial | Martin Marietta Materials |

| Adobe | Lennar |

Amgen, the biopharmaceutical company, was the top contributor for the quarter. The company continues to leverage its innovative platform to strengthen its product portfolio, offset maturing products, such as Epogen and Neulasta, and increase market share. Over the past year, Amgen has reported double-digit volume growth, operating margin expansion to over 40% and record levels of sales for cholesterol drug Repatha, bone-strengthening drug Prolia and cancer drug Blincyto. Additionally, the company remains well positioned to benefit from the continued development and commercialization of biosimilars such as Amgevita, the first biosimilar to Humira, and the successful integration of Otezla to bolster its inflammation segment. Lastly, the FTC agreed to allow Amgen to proceed with its $27.8 billion acquisition of Horizon Therapeutics. We note that this is yet another unsuccessful attempt by the FTC to block an M&A transaction of one of our holdings (see below re: Activision Blizzard). The transaction closed on October 6, 2023 and brings expertise in rare disease therapies (including bulging eye-drug Tepezza) as well as adds to Amgen’s immunology portfolio.

Phillips 66, a diversified refiner, chemicals and midstream energy company, was a leading contributor for the quarter. While still perceived by many as just a refiner, we continue to be impressed by the company’s ongoing transformation to a more diversified energy business. Consistent with this strategy, Phillips 66 completed the acquisition of DCP Midstream, which expands its NGL (natural gas liquids) business that now spans the entire natural gas value chain, from wellhead to end user. In addition, the company remains on track in converting its San Francisco refinery into one of the world’s largest renewable fuels facilities, with commercial operations set to begin in early 2024. The firm has also made progress on various projects designed to enhance efficiency, increase utilization and bolster capture rates, which can deliver $800 million in cost savings by the end of 2023. With these improvements, as well as further optimization of its midstream and chemicals businesses, we believe Phillips 66 is well positioned to increase its FREE cash flow generation as it continues to become “much more than a refiner.”

Xylem, the water equipment and services supplier, was the largest detractor for the quarter. After closing the transformational acquisition of Evoqua in May 2023, long-time CEO Patrick Decker announced he would retire at the end of 2023 and COO Matthew Pine will step into the top position. Concurrently, Xylem announced a change in its CFO, with William Grogan joining from IDEX Corporation where he served as CFO since 2017. While C-suite turnover is not desirable, it is inevitable. Moreover, we see the company’s succession planning as well thought out and well executed. Meanwhile, Xylem reported double-digit increases in revenue across all segments and end markets amid strong global demand from public utilities, as well as industrial, commercial and residential clients, that seek solutions to treat, test, transport and preserve water. We believe Xylem’s portfolio of highly differentiated pumps, recognized for their quality and critical uses, as well as the company’s ability to cross‐sell and link other products such as sensors and smart meters, will make it a one‐stop shop for utilities and protect the company from pure price competition. In our opinion, long‐term trends, such as water scarcity and the need to replace aging water infrastructure, create strong underlying demand for Xylem’s products through various parts of the economic cycle. We will evaluate the announced management transitions and will closely monitor the company’s ongoing integration of Evoqua.

Microchip Technology, the microcontroller (MCU) and analog semiconductor producer, was a primary detractor for the period. Despite posting record levels of sales, margins and gross profit, management indicated it expects a challenging near-term demand environment due to weakness in China, a slowdown in Europe and early signs of weakness in auto. The company has also accommodated some push-out requests from customers, which will translate into lower sales for the coming months. Despite operating in a cyclical industry, Microchip has been able to generate 15+ years of robust FREE cash flow and margins, while lowering its debt (has paid down $6.8 billion of debt over the last 20 quarters, reducing net leverage to 1.29x) and consistently returning money to shareholders. This, we believe, speaks to management’s proven ability to manage the business through economic cycles, while taking advantage of its broad portfolio to continue gaining share in areas including IoT, 5G infrastructure, autonomous driving and data centers.

Recent Portfolio Activity

| Buys | Sells |

|---|---|

| None | Activision Blizzard |

During the quarter, we sold our position in Activision Blizzard.

We first purchased Activision Blizzard, one of the largest video game companies in the world, during the second quarter of 2023. We have long appreciated the critical role Activision Blizzard’s gaming franchises play for PlayStation, Xbox and the broader gaming industry. Moreover, we believe the company is on the path toward increasing its revenue from new products that rely on in-game transactions and advertising, as well as through further leveraging its intellectual property from consoles and PCs into mobile games. At the time of purchase, there was heightened uncertainty regarding whether regulators would approve the pending acquisition of the company by Microsoft, a current Value Equity holding. This, we believe, provided an opportunity for us to own Activision Blizzard at an attractive discount to our estimates of intrinsic value should the company remain independent. Conversely, if the transaction commenced and Activision Blizzard was indeed acquired, we would still benefit through our investment in Microsoft. As such, rather than attempting to predict regulatory approval of the transaction, we instead saw the company as an optimal investment. With the uncertainties regarding regulatory approval nearly disappearing, we decided to exit our investment.

Conclusion

Rather than attempting to predict short-term market dynamics, at Aristotle Capital, we stay focused on understanding company fundamentals while carefully monitoring the long-term evolution of our portfolio of holdings. Our approach to understanding individual businesses reveals more insightful conclusions than would undue time spent concentrating on ever-changing and often unclear macroeconomic signals. While we strive to remain macro aware, our goal instead is to invest in businesses which are run by what we believe are capable and proven management teams that have the skill to navigate changing factors such as inflation, interest rates and government policy. We also analyze how such factors could alter the fundamentals of a business and whether those impacts are long term in nature.

We aim to find companies with high-quality characteristics that can succeed over full market cycles. It is our belief that a disciplined, research-oriented approach to finding great companies, as well as a consistent, well-executed portfolio management process, is how we can add the most value for our clients.

The opinions expressed herein are those of Aristotle Capital Management, LLC (Aristotle Capital) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to purchase or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Capital makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle Value Equity strategy. Not every client’s account will have these characteristics. Aristotle Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Capital’s Value Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Capital does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Capital Management, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Capital, including our investment strategies, fees and objectives, can be found in our ADV Part 2, which is available upon request. ACM-2310-24

Composite returns for all periods ended September 30, 2023 are preliminary pending final account reconciliation.

Past performance is not indicative of future results. The information provided should not be considered financial advice or a recommendation to purchase or sell any particular security or product. Performance results for periods greater than one year have been annualized. The Aristotle Value Equity strategy has an inception date of November 1, 2010; however, the strategy initially began at Mr. Gleicher’s predecessor firm in October 1997. A supplemental performance track record from January 1, 2001 through October 31, 2010 is provided above. The returns are based on two separate accounts and performance results are based on custodian data. During this time, Mr. Gleicher had primary responsibility for managing the two accounts, one account starting in November 2000 and the other December 2000.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The Russell 1000 Value® Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Dow Jones Industrial Average® is a price-weighted measure of 30 U.S. blue-chip companies. The Index covers all industries except transportation and utilities. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite includes over 3,000 companies, more than most other stock market indexes. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment grade bonds, including corporate, government and mortgage-backed securities. The WTI Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil consumed in the United States. The Brent Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. The 3-Month U.S. Treasury Bill is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of three months. Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The volatility (beta) of the Composite may be greater or less than its respective benchmarks. It is not possible to invest directly in these indexes.