(All MSCI index returns are shown net and in U.S. dollars unless otherwise noted.)

Markets Review

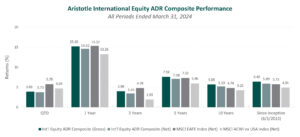

Sources: CAPS CompositeHubTM, Bloomberg

Past performance is not indicative of future results. Aristotle International Equity ADR Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Capital Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

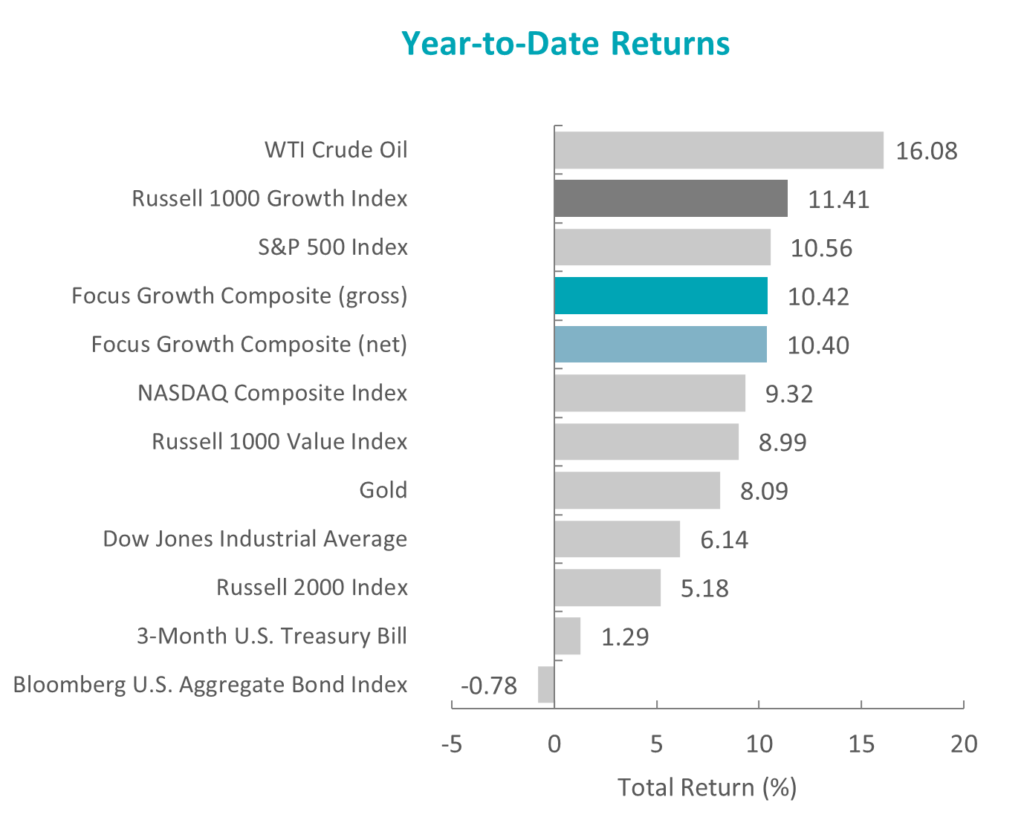

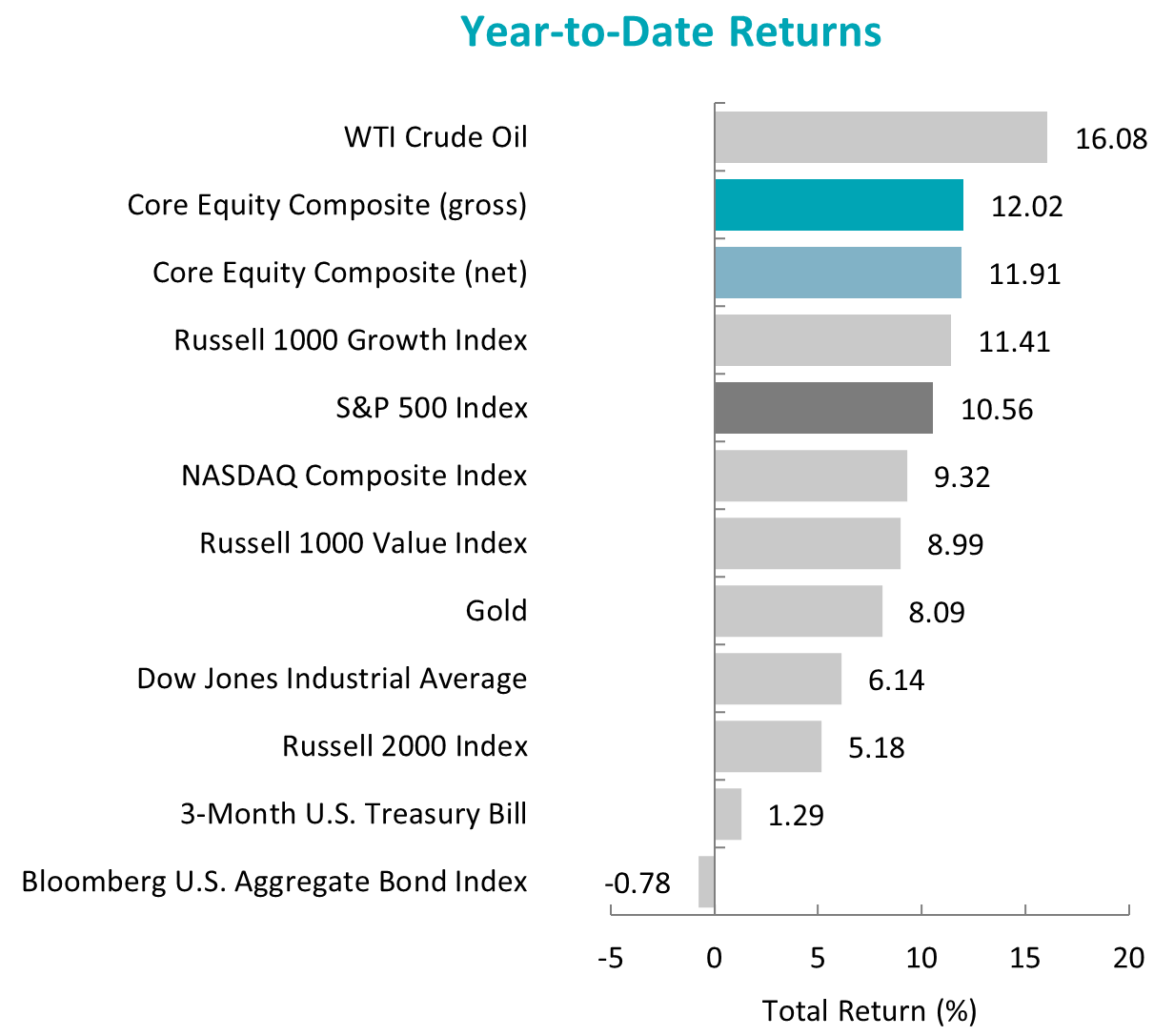

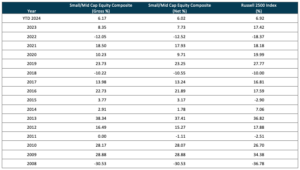

Global equity markets continued to climb during the first quarter. Overall, the MSCI ACWI Index rose 8.20% during the period. Concurrently, the Bloomberg Global Aggregate Bond Index fell 2.08%. In terms of style, value stocks underperformed their growth counterparts during the quarter, with the MSCI ACWI Value Index trailing the MSCI ACWI Growth Index by 2.65%.

The MSCI EAFE Index climbed 5.78% during the first quarter, while the MSCI ACWI ex USA Index increased 4.69%. Within the MSCI EAFE Index, Asia and Europe & Middle East were the strongest performers, while the U.K. gained the least. On a sector basis, eight of the eleven sectors within the MSCI EAFE Index posted positive returns, with Information Technology, Consumer Discretionary and Financials generating the largest gains. Conversely, Utilities, Consumer Staples and Materials declined.

Economic conditions varied by region, though most developed countries reported slowing inflation. For the month of February, both the U.K. and U.S. reported annual inflation descending toward the 3% mark, while the eurozone recorded an annual rate of 2.6%. As such, the respective central banks held monetary policy steady while signaling the possibility of rate cuts starting in June as the countries make progress toward the 2% target.

However, in Asia, Japan raised interest rates for the first time since 2007 to a range of 0.0% to 0.1%, as both inflation and wage growth have recently accelerated. This marked a historic shift and ended Japan’s period of negative rates, finally removing the world’s last remaining negative rates regime. Conversely, China lowered its five-year loan prime rate to bolster its faltering economy that is battling deflation and a troubled real estate sector.

In geopolitics, the conflict in the Middle East continued, with increased fighting in Lebanon and direct conflict in the Red Sea between the U.S. and Yemen’s Houthis, which have targeted more than two dozen ships traveling to and from the Suez Canal. The heightened activity in surrounding countries has sparked concerns of further regional escalation and the possibility of a wider conflict. In Europe, Russia made small advances in Ukraine, including the capture of the city of Avdiivka, as Ukrainian troops struggle with supply shortages. The U.S. has recently partnered with countries such as South Korea and Turkey to provide additional ammunition and supplies to Ukraine.

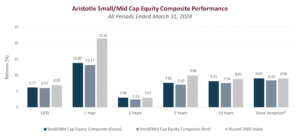

Performance and Attribution Summary

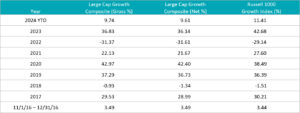

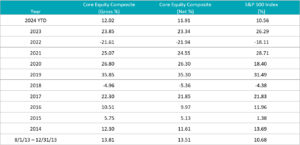

For the first quarter of 2024, Aristotle Capital’s International Equity ADR Composite posted a total return of 3.89% gross of fees (3.73% net of fees), underperforming the MSCI EAFE Index, which returned 5.78%, and the MSCI ACWI ex USA Index, which returned 4.69%. Please refer to the table below for detailed performance.

| Performance (%) | 1Q24 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception* |

|---|---|---|---|---|---|---|

| International Equity ADR Composite (gross) | 3.89 | 15.18 | 3.99 | 7.59 | 5.69 | 6.40 |

| International Equity ADR Composite (net) | 3.73 | 14.62 | 3.45 | 7.08 | 5.19 | 5.89 |

| MSCI EAFE Index (net) | 5.78 | 15.32 | 4.78 | 7.32 | 4.79 | 5.73 |

| MSCI ACWI ex USA Index (net) | 4.69 | 13.26 | 1.93 | 5.96 | 4.25 | 4.91 |

Source: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income.

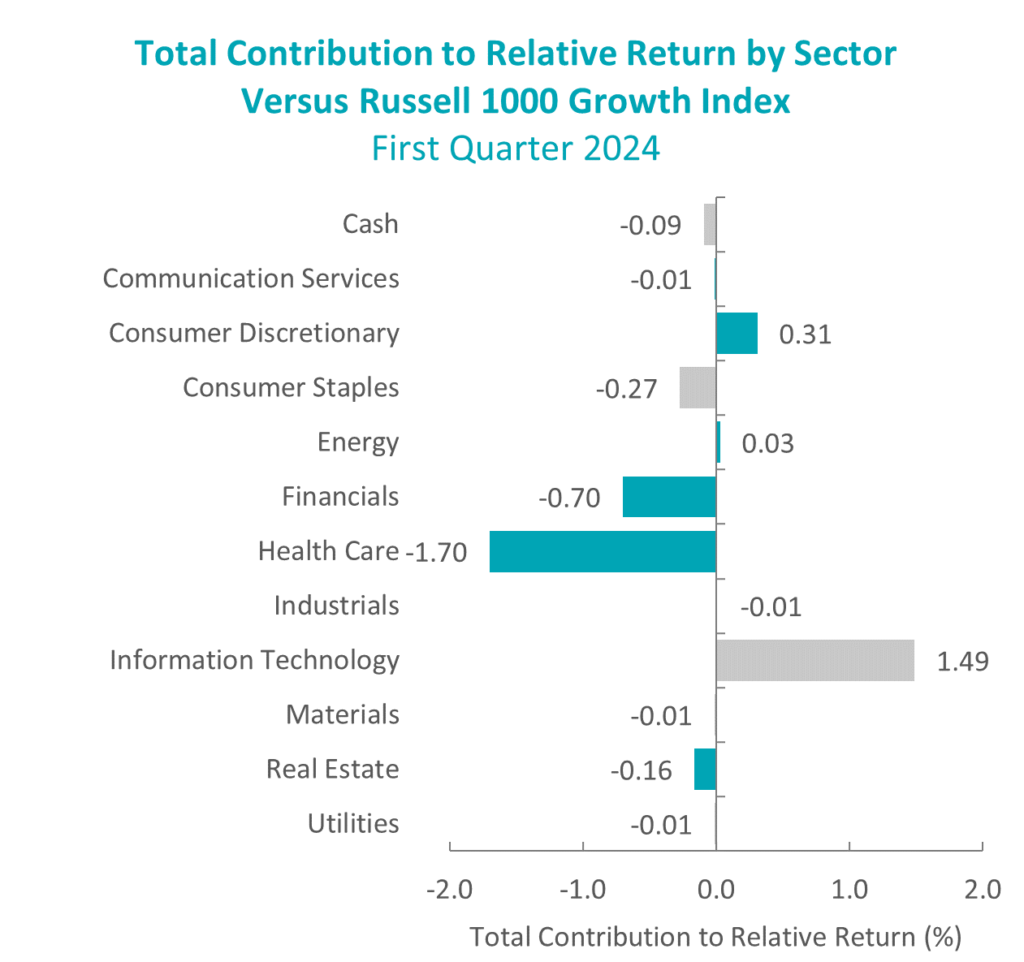

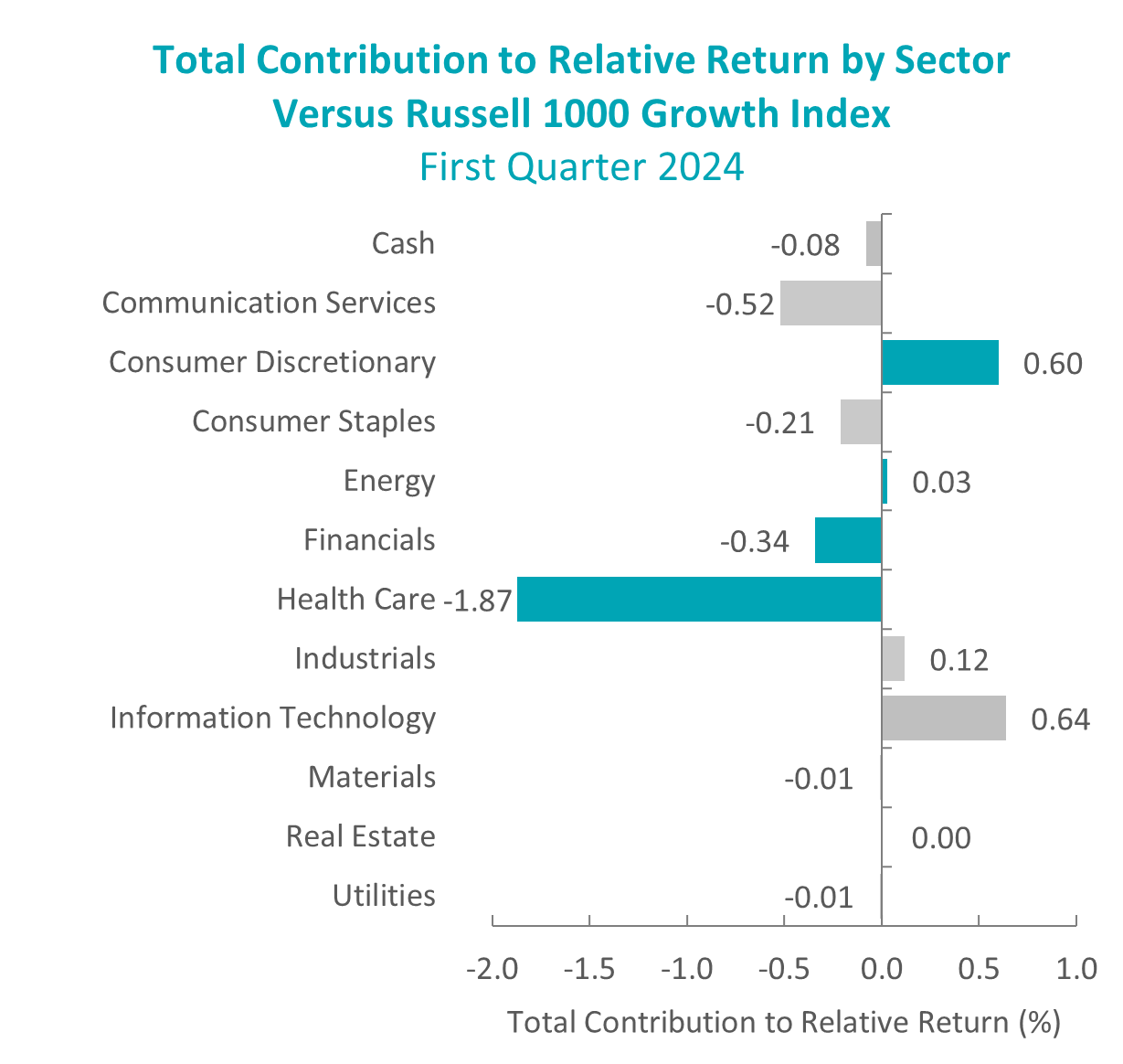

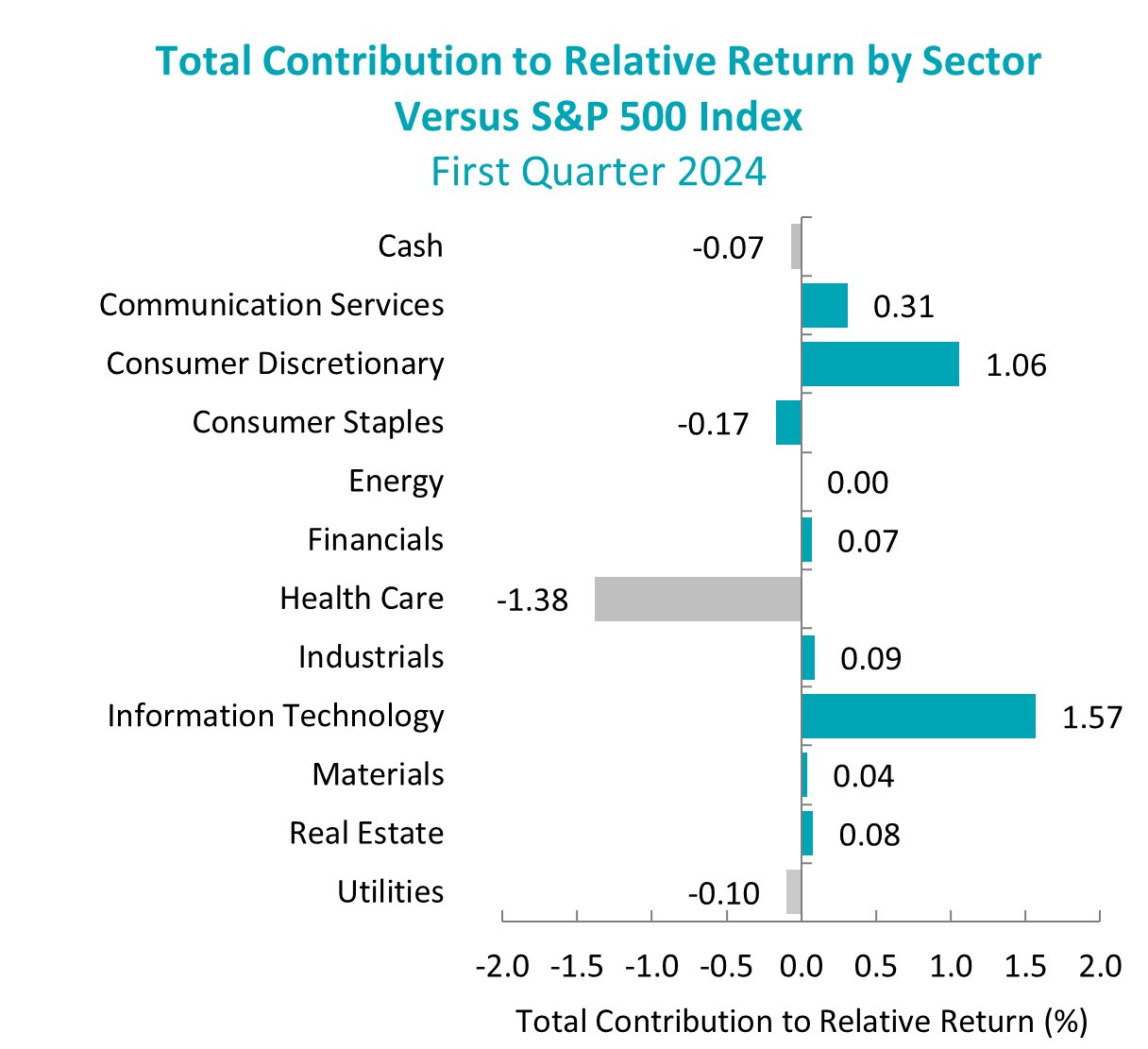

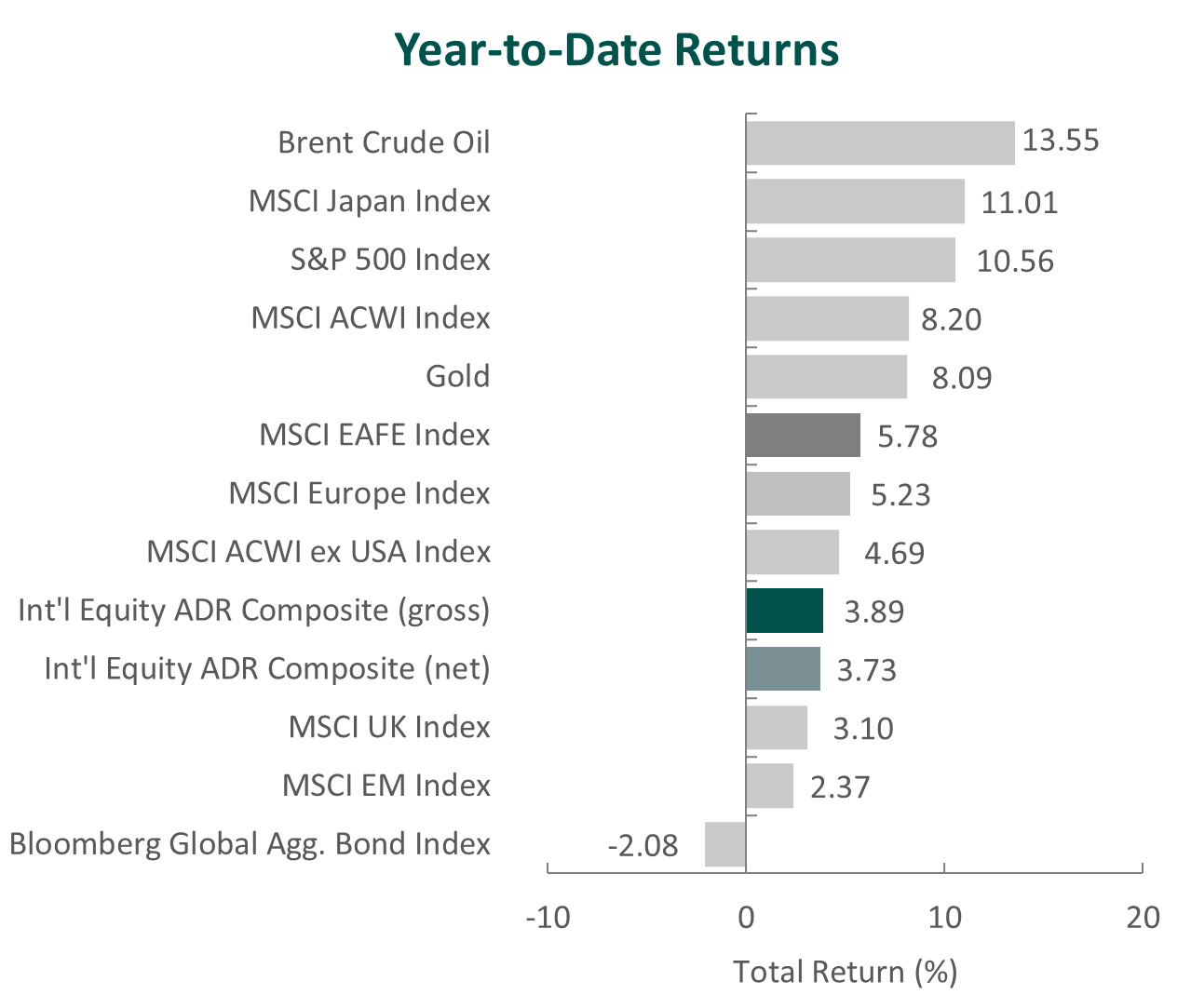

From a sector perspective, the portfolio’s underperformance relative to the MSCI EAFE Index can be attributed to security selection, while allocation effects had a positive impact. Security selection in Consumer Discretionary, Information Technology and Industrials detracted the most from the portfolio’s relative performance. Conversely, security selection in Consumer Staples and Health Care and a lack of exposure to Utilities contributed to relative return.

Regionally, both security selection and allocation effects were responsible for the portfolio’s underperformance. Security selection in Asia and exposure to Canada detracted the most from relative performance, while security selection in the U.K. and Europe & Middle East contributed.

Contributors and Detractors for 1Q 2024

| Relative Contributors | Relative Detractors |

|---|---|

| Safran | Daikin Industries |

| Munich Reinsurance | Sony |

| GlaxoSmithKline | AIA Group |

| Pan Pacific International | Accenture |

| Credicorp | Azko Nobel |

Sony, the global provider of videogames and consoles, image sensors, music and movies, was one of the largest detractors for the period. Sony cut its guidance from 25 million PlayStation 5 (PS5) units sold to 21 million units for the fiscal year. Despite the underwhelming hardware results, management has emphasized the importance of balancing profitability and sales in the latter stage of the PS5’s life cycle which it expects to achieve through engagement, with monthly active users reaching a record high of 123 million accounts. Furthermore, we will continue to monitor management’s ability to improve game development, streamline project management and control costs, as Sony has already begun to implement structural reforms in its Game & Network Services segment. In its Pictures segment, Sony terminated its merger with Zee Entertainment, as closing conditions were not met within the set two-year window. Nevertheless, management believes India remains a promising market and will proactively explore opportunities to bolster its position in the country. We remain confident in Sony’s ability to build on its industry leadership, and we feel the company’s continued optimization of business operations, including its plan for a partial spinoff of its Financial Services business, positions the company to enhance long-term value.

AIA Group, a pan-Asian life insurance company headquartered in Hong Kong, was one of the largest detractors for the quarter. While macro concerns over the state of the Chinese economy may have placed pressure on AIA’s share price during the quarter, business fundamentals continue to improve. As evidence, the company’s VONB* increased 33% in 2023. This, in our opinion, reflects AIA’s resiliency and the progress it has made across Asia, with mainland China, Hong Kong and the ASEAN countries (excluding Vietnam) all reporting double-digit percentage increases. The company has also completed a multi-year digital transformation that has not only reduced costs per transaction by over 30% but has also improved customer experience. (85% of customer transactions are now completed in a day or less.) With these technological investments in place, the support of its highly productive agency sales force, and further partnerships with major banks, we remain confident in AIA’s ability to continue increasing its market share in mainland China and expanding across Asia.

*Value of New Business (VONB) is an insurance term for the present value of new business written during a period.

Safran, the French aerospace propulsion and equipment manufacturer, was the top contributor. As the leading supplier of narrow-body aircraft engines, Safran has benefited from the increase in narrow-body air traffic (above 2019 levels) and an aging fleet of aircraft that has spurred demand for required service. Part of our attraction to Safran is the nature of its product categories, which tend to exhibit pricing power, and the benefits of higher-margin aftermarket businesses, which we expect to expand in the years ahead. As an example, the company recently signed several multi-year equipment contracts with international airline customers. In addition, deliveries of Safran’s new-generation LEAP engines (which reduce fuel consumption and CO2 emissions) increased 38% in 2023, supporting the company’s proposed 63% year-over-year dividend increase. Longer term, we believe Safran will benefit from the continued transition to LEAP engines as airlines upgrade their fleets to be more efficient and environmentally friendly.

Munich Re, the world’s largest reinsurance company, was a leading contributor for the quarter. The company reported strong results as it continues to win market share, leverage its global scale and demonstrate underwriting discipline. Perhaps counterintuitively, recent global crises, such as war in both the Middle East and Ukraine and natural disaster losses that topped $100 billion, as well as the impact of inflation, showcase Munich Re’s strengths. Through these crises, the company has, we believe, displayed its prudent risk-taking and global diversification. Moreover, Munich Re (and its peers) have benefited from industry-wide price increases, which have contributed to increased return of capital to shareholders. The company raised its dividend by nearly 30% in 2023 and announced a new €1.5 billion share buyback program. We continue to believe Munich Re is attractively positioned to gain market share in a variety of areas, including cybersecurity, specialty insurance and in the fast-growing economies in Asia where the market is large, but insurance penetration remains relatively low.

Recent Portfolio Activity

| Buys | Sells |

|---|---|

| dsm-firmenich | None |

During the quarter, we invested in dsm-firmenich. Following the merger of DSM and Firmenich, an ADR was reintroduced, allowing us to add the company to the ADR portfolio. We have owned the company for clients invested in our ordinary share portfolio since the fourth quarter of 2022.

dsm-firmenich

Founded in 1902, dsm-firmenich is a Dutch-Swiss multinational corporation. The company has nearly 30,000 employees (including more than 2,000 scientists in 15 research laboratories) across 60 countries. dsm-firmenich produces flavors, fragrances and pure active ingredients (e.g., vitamins, lipids, minerals, enzymes and UV filters) that go into a wide range of products, including food, drinks, medical nutrition, cosmetics, and pet and animal products.

Over the past two decades, legacy DSM has gone through a dramatic transformation, divesting nearly all of its cyclical, commodity chemicals businesses and investing the proceeds in specialty nutrition product companies with more stable sales and higher profit margins. The 2023 merger with Firmenich, a global flavors and fragrances company, completed the transition into a pure-play nutrition, health and ingredients company. The combined businesses, now known as dsm-firmenich, have more than €12 billion in annual revenue across four segments: Perfumery & Beauty (~30% of sales); Animal Nutrition & Health (25%); Taste, Texture & Health (25%); and Health, Nutrition & Care (20%).

High-Quality Business

Some of the quality characteristics we have identified for dsm-firmenich include:

- Leading market share positions in numerous categories;

- Many markets dsm-firmencich participates in consolidated and enjoy stable margins due to high barriers to entry; and

- Scale and global footprint results in close relationships with.

Attractive Valuation

Valuation is attractive based on our estimates of higher normalized cash earnings power. Moreover, we believe the current valuation reflects dsm-firmenich’s historical status as a commodity conglomerate and does not fully appreciate the improvement in quality that can be created as a result of the merger with Firmenich. We recognize this transaction is the largest in dsm-firmenich’s history and brings considerable integration risks; however, we believe current valuation provides a margin of safety for the long-term investor.

Compelling Catalysts

Catalysts we have identified for dsm-firmenich, which we believe will cause its stock price to appreciate over our three- to five-year investment horizon, include:

- Successful integration of Firmenich merger, as well as previous bolt-on acquisitions, can produce revenue and expense synergies, along with an improved business mix;

- Continued market share gains from recently launched product innovations (e.g., Bovaer, an animal health nutritional product that reduces methane emissions); and

- Balance sheet optionality as low leverage allows for increased return of capital to shareholders while simultaneously continuing bolt-on acquisitions.

Conclusion

Despite the U.S. economy’s continued expansion, economic data points remain mixed. Additionally, investors face uncertainty the rest of the year, whether it be the path of central bank policy, the outcome of the 2024 U.S. presidential election, or the potential for new and/or escalating geopolitical conflicts.

However, while our analysis considers long-term developments in the macroeconomy, we focus most of our time and attention on individual companies that, in our opinion, possess a combination of qualities that are sustainable and difficult to reproduce. It is our belief that a diversified portfolio of investments in these companies will thrive over full market cycles.

The opinions expressed herein are those of Aristotle Capital Management, LLC (Aristotle Capital) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to buy or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Capital makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle International Equity ADR strategy. Not every client’s account will have these characteristics. Aristotle Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Capital’s International Equity ADR Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Capital does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Capital Management, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Capital, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACM-2404-109

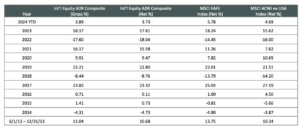

Sources: CAPS CompositeHubTM, MSCI

Composite returns for all periods ended March 31, 2024 are preliminary pending final account reconciliation.

Past performance is not indicative of future results. The information provided should not be considered financial advice or a recommendation to purchase or sell any particular security or product. Performance results for periods greater than one year have been annualized.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The MSCI ACWI captures large and mid-cap representation across 23 developed market countries and 24 emerging markets countries. With approximately 3,000 constituents, the Index covers approximately 85% of the global investable equity opportunity set. The MSCI ACWI Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 developed markets countries (excluding the United States) and 24 emerging markets countries. With approximately 2,300 constituents, the Index covers approximately 85% of the global equity opportunity set outside the United States. The MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 24 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Brent Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. The MSCI Japan Index is designed to measure the performance of the large and mid-cap segments of the Japanese market. With approximately 250 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in Japan. The Bloomberg Global Aggregate Bond Index is a flagship measure of global investment grade debt from 28 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The MSCI United Kingdom Index is designed to measure the performance of the large and mid-cap segments of the U.K. market. With nearly 100 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in the United Kingdom. The MSCI Europe Index captures large and mid-cap representation across 15 developed markets countries in Europe. With approximately 430 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization across the European developed markets equity universe. These indexes have been selected as the benchmarks and are used for comparison purposes only. The volatility (beta) of the Composite may be greater or less than the respective benchmarks. It is not possible to invest directly in these indexes.