Markets Review

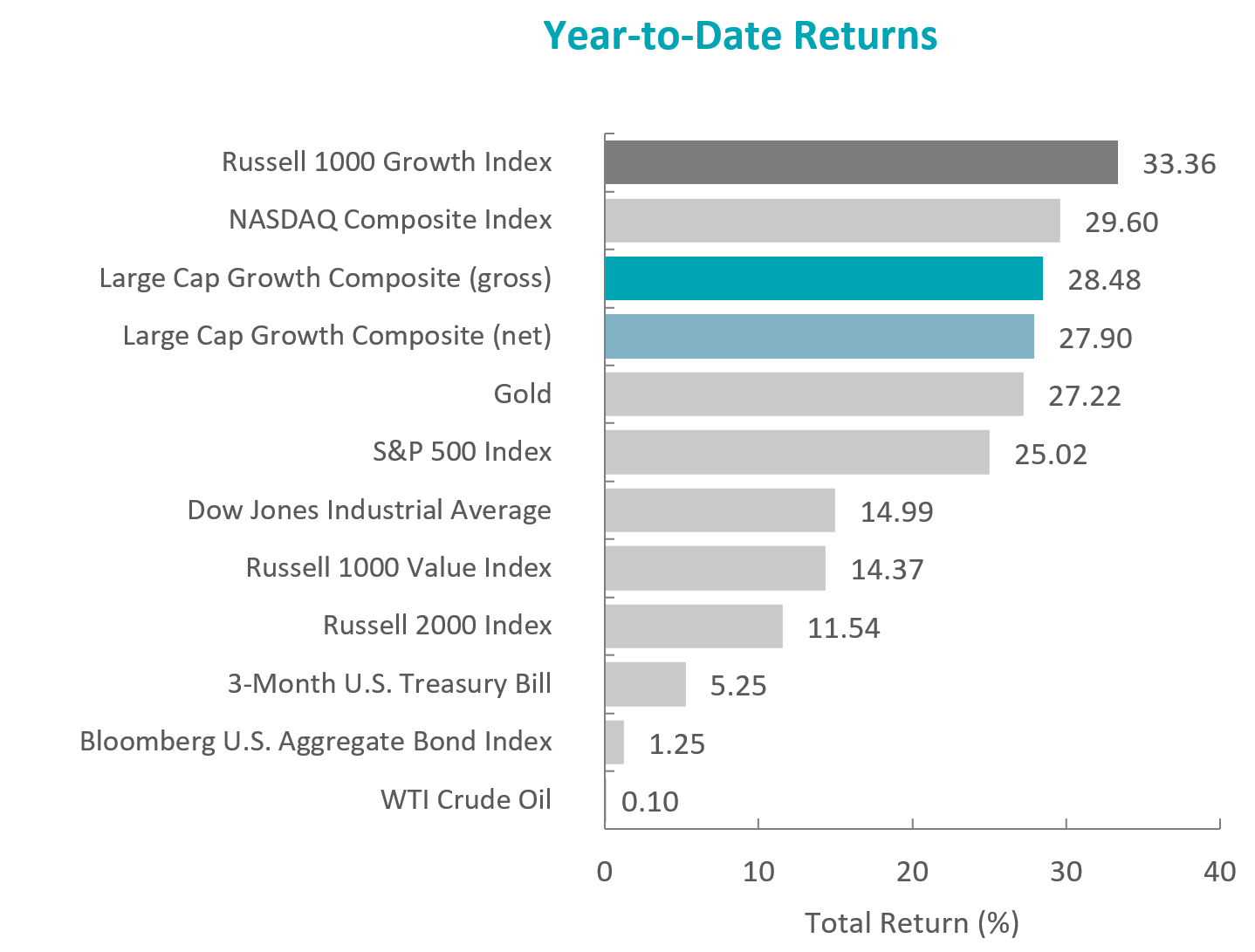

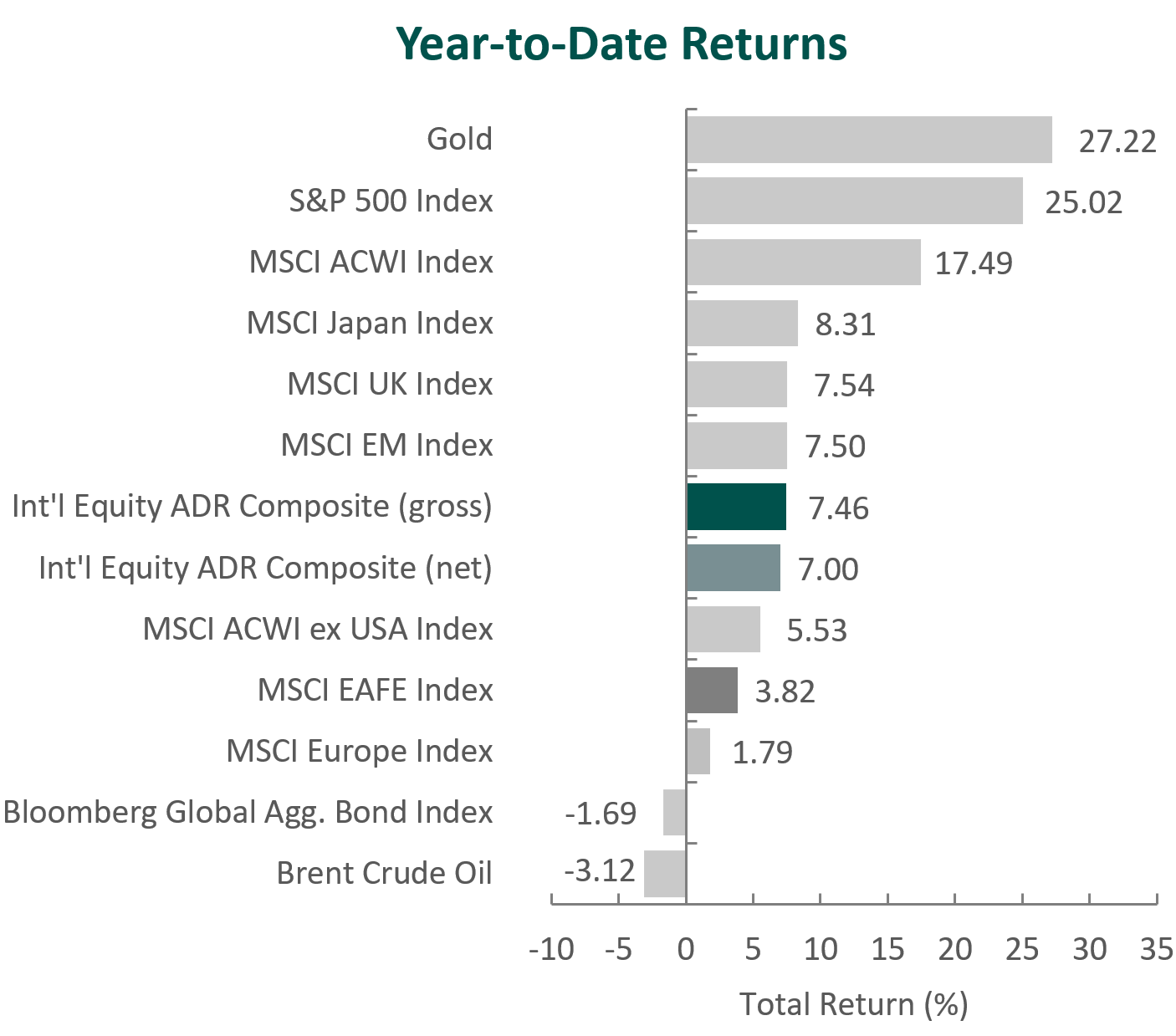

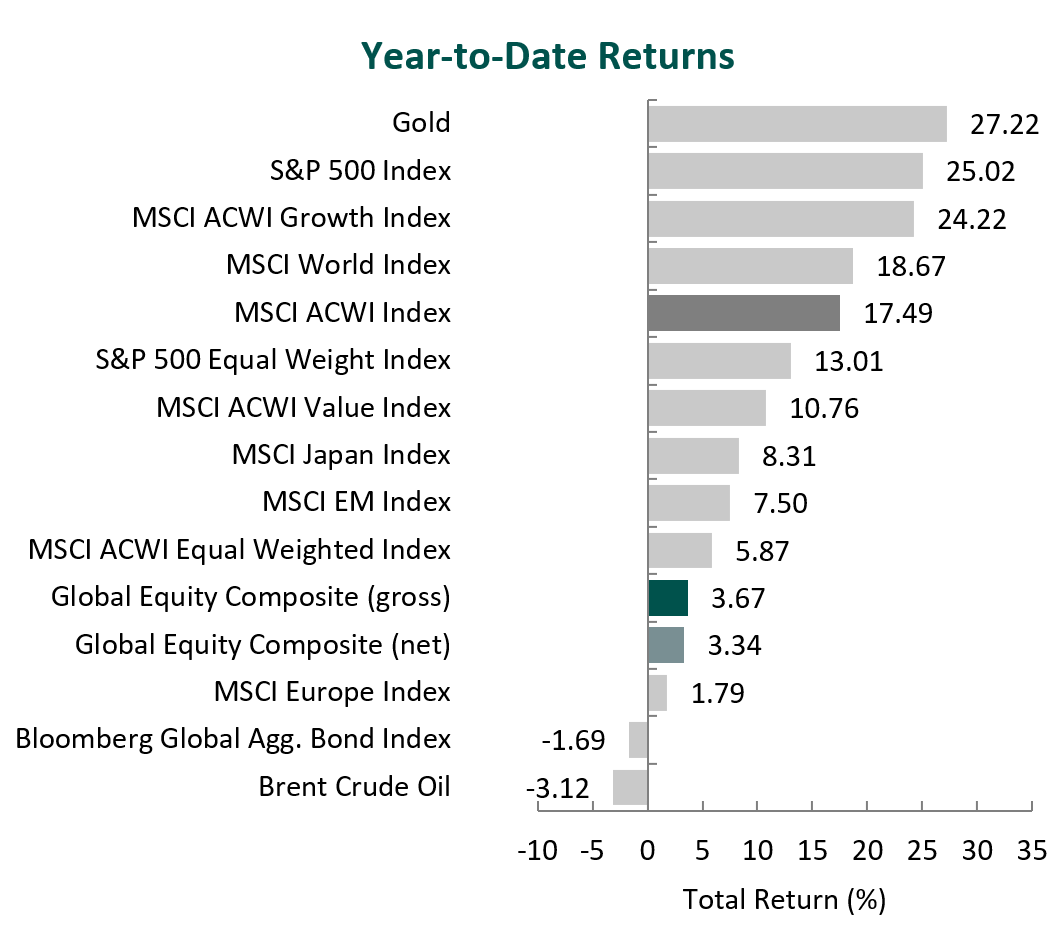

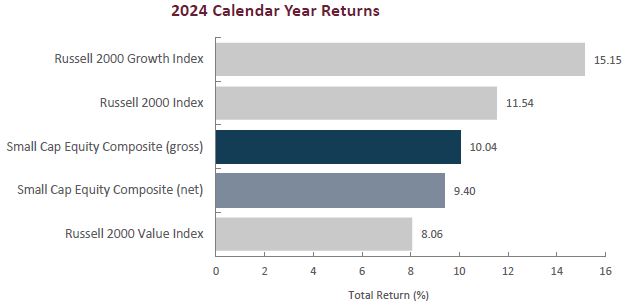

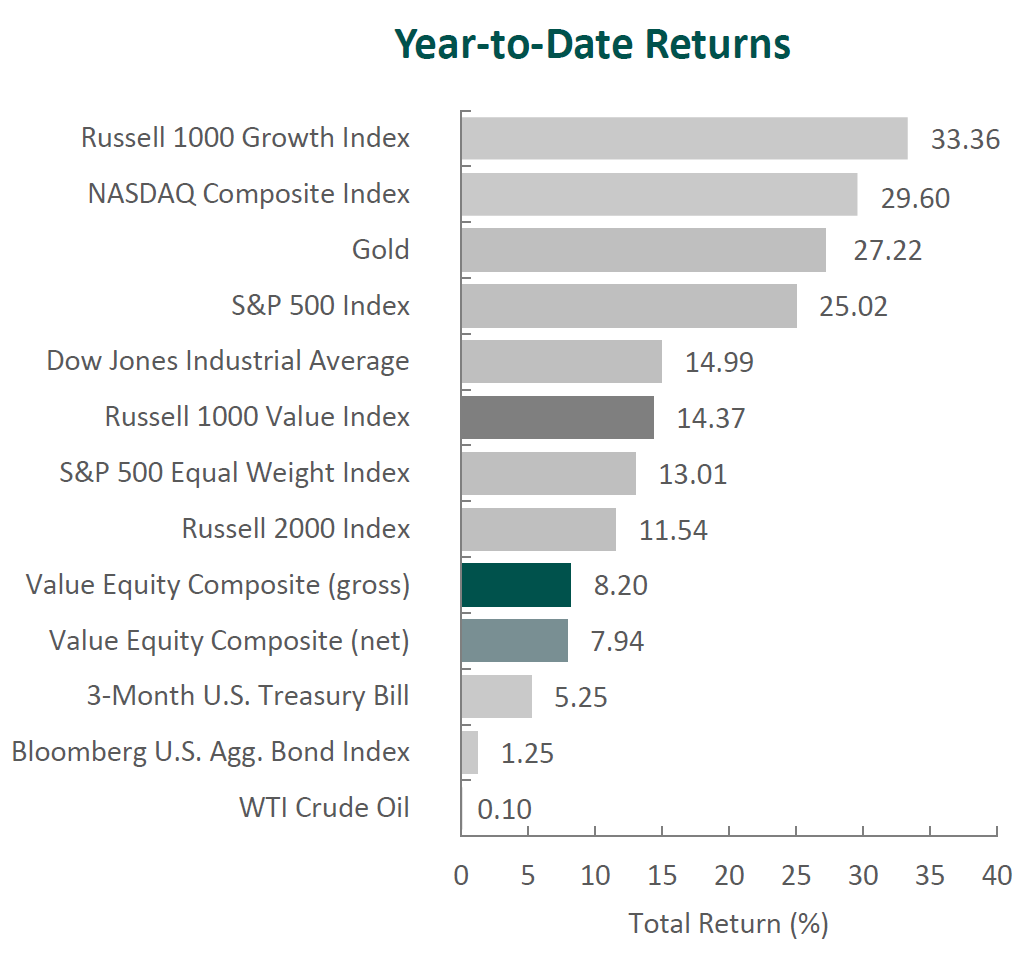

The U.S. equity market ended the year on a strong note, with the S&P 500 Index rising 2.41% during the period. In contrast, the Bloomberg U.S. Aggregate Bond Index declined, falling 3.06% for the quarter.

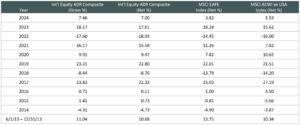

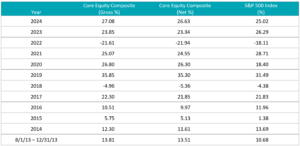

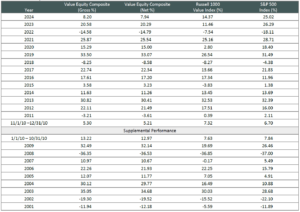

Sources: CAPS CompositeHubTM, Bloomberg

Past performance is not indicative of future results. Aristotle Atlantic Focus Growth Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Atlantic Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

On a sector basis, gains were made from six of the eleven sectors within the Russell 1000 Growth Index, led by Consumer Discretionary and Energy. The worst-performing sectors were Real Estate and Materials.

The U.S. economy continued to demonstrate resilience, with real GDP growing at an annualized rate of 3.1%, according to the BEA’s most recent report. Increases in consumer spending, exports, nonresidential fixed investment and federal government spending drove the economic expansion. Retail sales rose 3.8% year-over-year in November, supported by a 2.7% increase in disposable personal income for the most recent quarter.

The labor market remained tight but showed signs of softening, as the unemployment rate edged up to 4.2% in November. Inflation remained relatively stable, rising modestly to an annual rate of 2.7%, as measured by the Consumer Price Index (CPI).

As was widely expected, the Federal Reserve (Fed) implemented two rate cuts during the quarter, setting the federal funds target rate at 4.25% to 4.50%. Fed Chair Jerome Powell emphasized the importance of finding a balance—reducing policy restraint too rapidly could hinder progress on inflation, while acting too slowly could weaken economic activity and the labor market. Still, he indicated that both the economy and monetary policy are on solid footing.

Corporate earnings also showed strength, as S&P 500 companies reported 5.8% earnings growth, marking the fifth consecutive quarter of positive results. A majority of companies exceeded EPS expectations, with only 61 companies issuing negative EPS guidance—the lowest figure since the fourth quarter of 2021. Looking ahead to 2025, consensus estimates project earnings growth of 14.8% for the calendar year, signaling optimism among analysts.

On the political front, Donald Trump was elected as the 47th president of the United States, becoming the first Republican to win the popular vote since 2004. The Republican Party also won the Senate and kept control of the House of Representatives, though with narrow majorities.

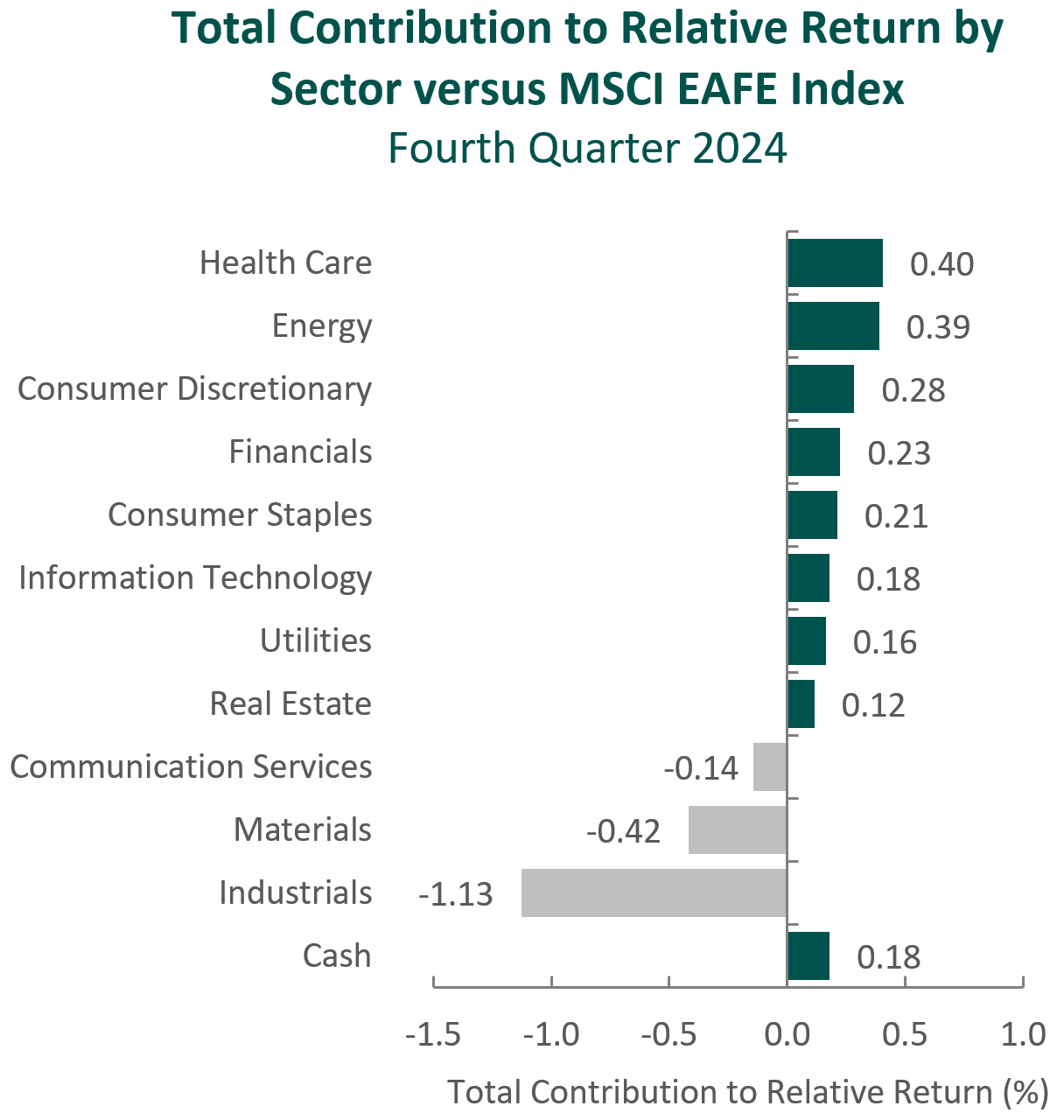

Performance and Attribution Summary

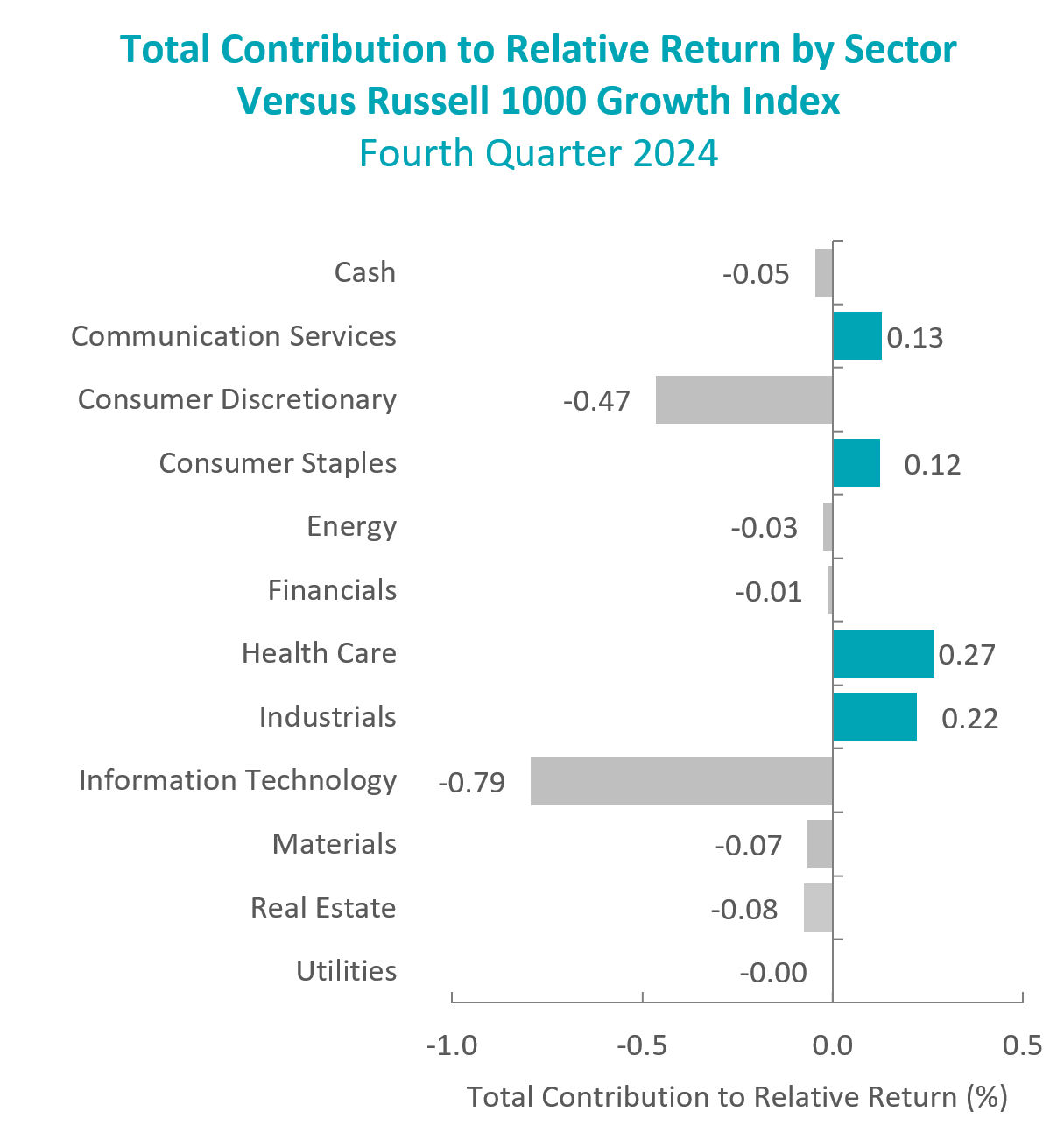

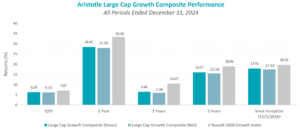

For the fourth quarter of 2024, Aristotle Atlantic’s Focus Growth Composite posted a total return of 5.05% gross of fees (5.03% net of fees), underperforming the 7.07% total return of the Russell 1000 Growth Index.

| Performance (%) | 4Q24 | 1 Year | 3 Years | 5 Years | Since Inception* |

|---|---|---|---|---|---|

| Focus Growth Composite (gross) | 5.05 | 29.69 | 5.90 | 15.56 | 14.89 |

| Focus Growth Composite (net) | 5.03 | 29.57 | 5.79 | 15.45 | 14.65 |

| Russell 1000 Growth Index | 7.07 | 33.36 | 10.47 | 18.96 | 17.83 |

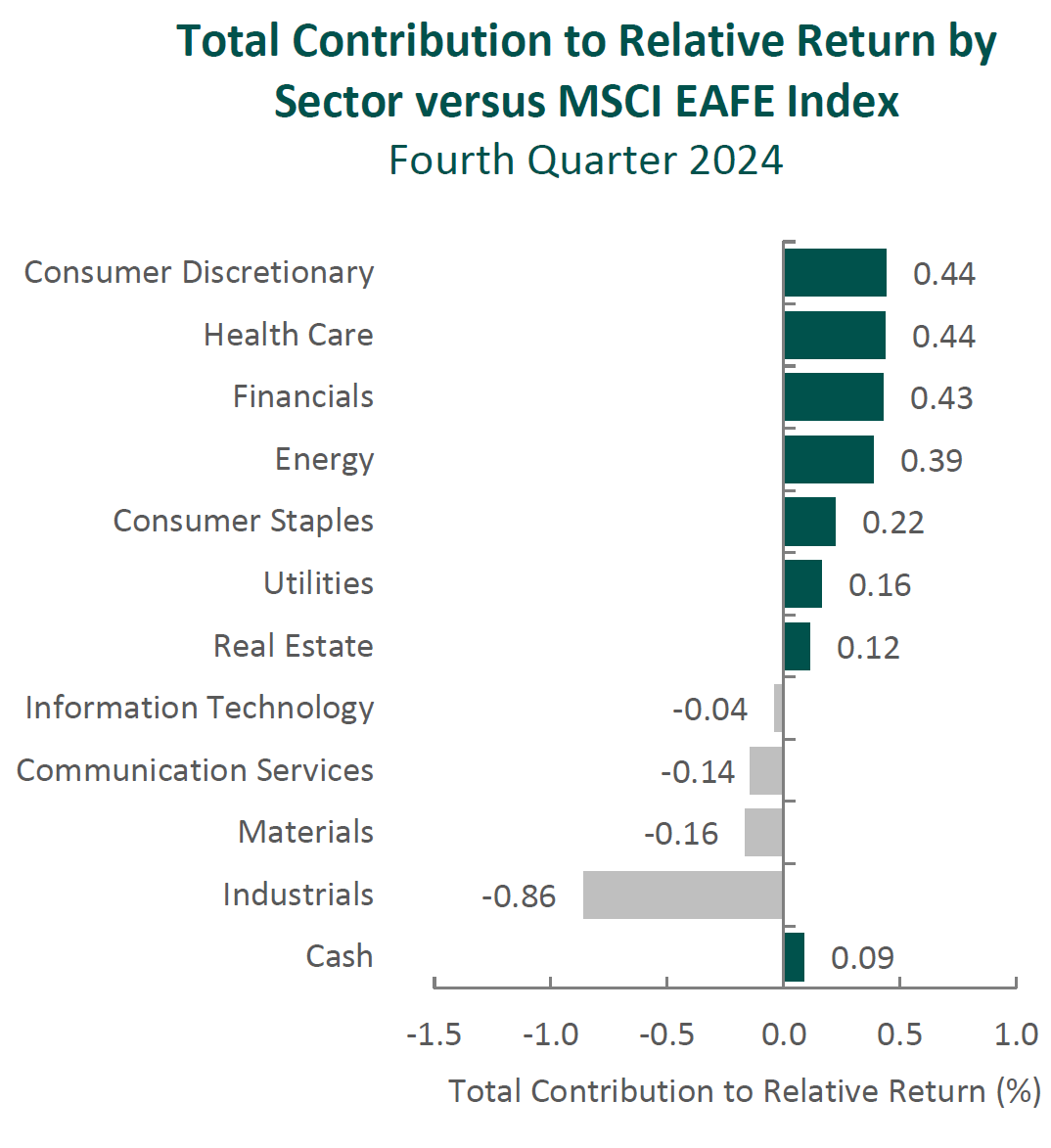

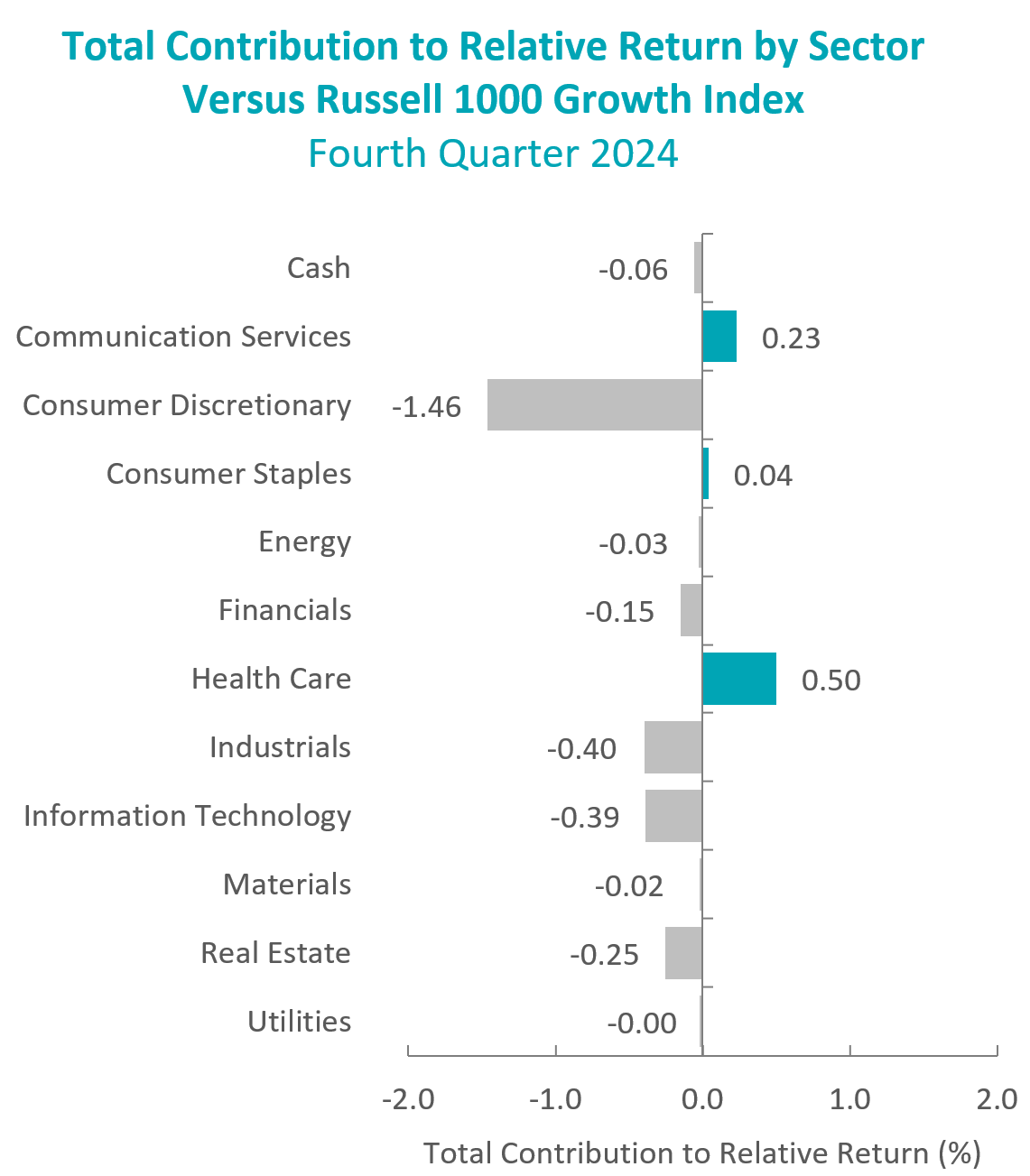

Sources: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income. Please see important disclosures at the end of this document.

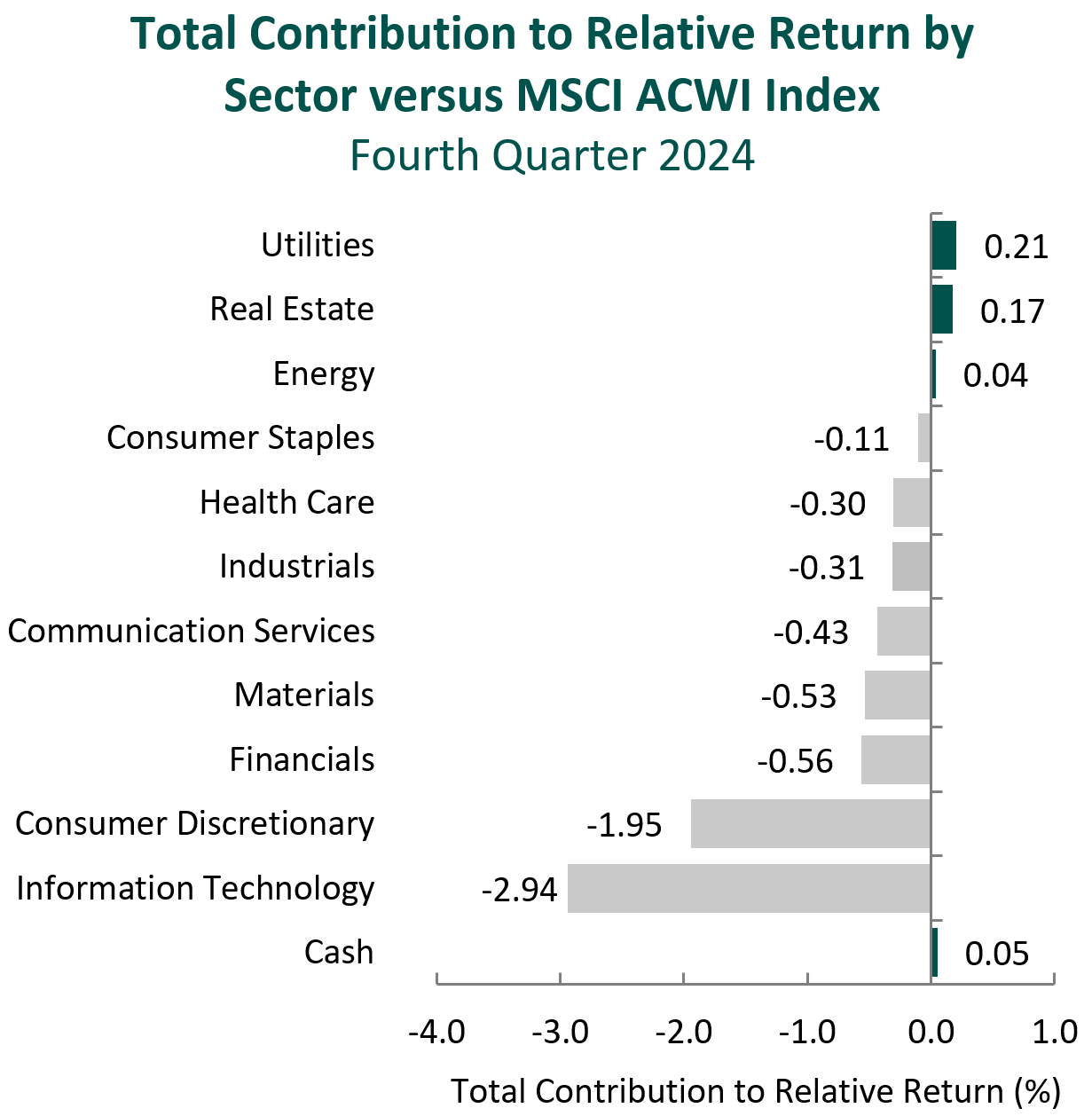

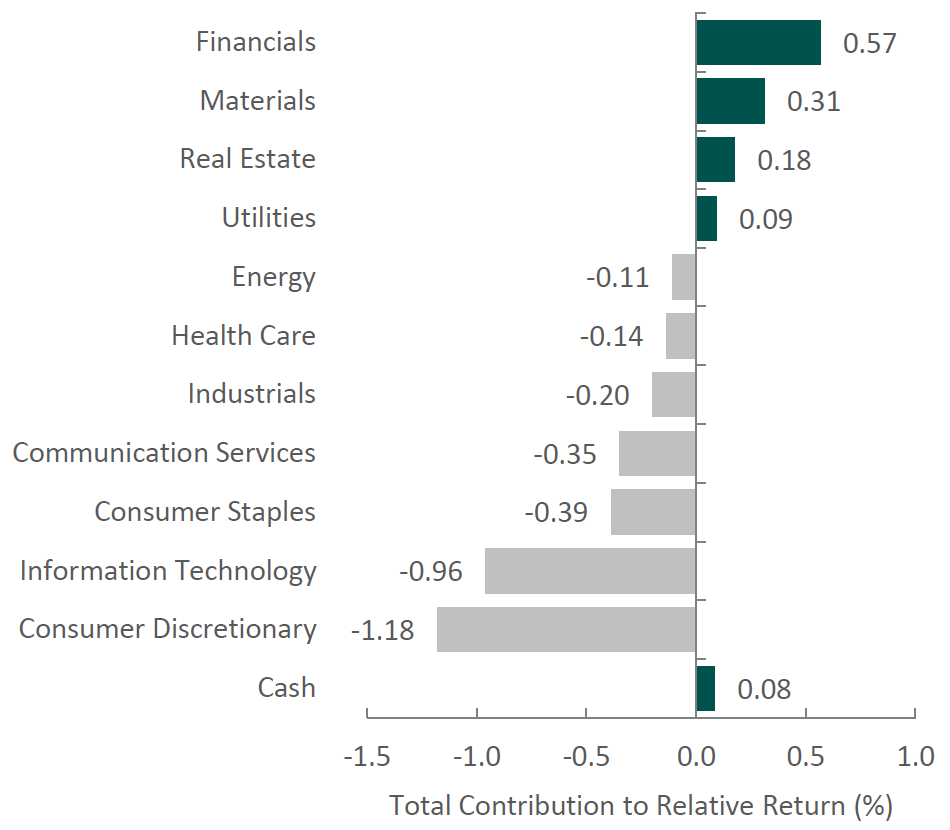

During the fourth quarter, the portfolio’s underperformance relative to the Russell 1000 Growth index was due to a combination of allocation effects and security selection. Security selection in Consumer Discretionary and Information Technology detracted the most from relative performance. Conversely, security selection in Health Care and Communication Services contributed.

Contributors and Detractors for 4Q 2024

| Relative Contributors | Relative Detractors |

|---|---|

| Expedia | UnitedHealth |

| Eli Lilly | Trane Technologies |

| Visa | Prologis |

| ServiceNow | Bio-Techne |

| Netflix | S&P Global |

Detractors

UnitedHealth

UnitedHealth Group detracted from performance in the fourth quarter following the tragic shooting of its insurance division CEO and increased focus on health insurance industry practices. A bipartisan bill was introduced that could force companies that own pharmacy benefit managers to divest their pharmacy operations, which would impact United’s Optum unit.

Trane Technologies

Trane Technologies detracted from performance in the fourth quarter of 2024. The company reported better than expected revenue and earnings growth at the end of October. The stock declined in December despite two investor conferences early in the month where the company reiterated expectations that current strong trends in commercial HVAC will continue into 2025, the service business is continuing to experience low double-digit growth, and the residential business is expected to improve from a lull in 2024. Higher interest rates have been a drag on industrial stock performance generally in December. Strength in the US dollar in 2025 will impact large cap companies like Trane, which have international exposure.

Contributors

Expedia

Expedia contributed to performance in the fourth quarter of 2024. In early November, the company reported better-than-expected EBITDA and EPS for the third quarter. Full-year guidance for 2024 was increased. The vacation rental business, Vrbo, returned to modest growth after a few quarters of decline. The balance sheet is close to target leverage ratio. There is a share repurchase authorization for approximately 13% of outstanding shares.

Eli Lilly

Eli Lilly contributed to performance in the fourth quarter. While shares underperformed, our underweight position versus the benchmark resulted in a positive contribution to relative returns. Lilly shares were weak following an uncharacteristic third quarter earnings miss driven by softer-than-expected sales of its blockbuster diabetes and obesity drugs. The company blamed this partly on wholesaler destocking. Lilly reinforced its view that end demand for the drugs remains strong.

Recent Portfolio Activity

The table below shows all buys and sells completed during the quarter, followed by a brief rationale.

| Buys | Sells |

|---|---|

| Eli Lilly | DexCom |

Buys

Eli Lilly

Eli Lilly is a leading pharmaceutical company that develops diabetes, oncology, immunology and neuroscience medicines. The company generates over half of its revenue in the U.S. from its leading drugs Trulicity, Verzenio and Taltz. The company operates in a single business segment: human pharmaceutical products.

Eli Lilly has a deep pipeline in treatment areas focused on metabolic disorders, oncology, immunology and central nervous system disorders. Currently, there are two phase-three assets: orforglipron, an oral GLP-1, and retatrutide, a triple incretin agonist, which could possibly expand upon the potential success of Mounjaro. We believe that Mounjaro has the potential to commercialize beyond Type 2 diabetes and obesity, potentially in the areas of heart disease, sleep apnea, fatty liver disease and chronic kidney disease. We believe the premium valuation is supported by this outsized growth profile.

Sells

Dexcom

We sold Dexcom after the surprisingly weak second quarter earnings report and only a modest recovery in the third quarter. The U.S. sales trends remain weak, and we believe that it could take a while for Dexcom to regain the premium multiple it has historically enjoyed. Dexcom is working to fix the durable medical equipment (DME) sales channel, and this could take time. The recently announced Stelo product for non-diabetic users could add an additional level of variability to quarterly earnings reports as well.

Outlook

The equity markets in the fourth quarter moved higher as investors anticipated a market benefit from a full sweep by Republicans in the November election. Interest rates for the quarter were little changed but did move sharply intraquarter due to a shift in the Fed away from a more accommodative policy. Expectations for 2025 include a couple of further rate reductions by the Fed and earnings increasing over 10% for the year. The markets will track closely the new administration’s stance on certain policies, along with the pace and level of reductions in regulations. Tariffs will be a focal point, as any action could add to concerns for higher inflation. Valuation levels remain elevated, and equity price appreciation will largely be dependent on earnings growth for the year. Our focus will continue to be at the company level, with an emphasis on seeking to invest in companies with secular tailwinds or strong product-driven cycles.

The opinions expressed herein are those of Aristotle Atlantic Partners, LLC (Aristotle Atlantic) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to purchase or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Atlantic makes in the future will be profitable or equal the performance of the listed in this report. The portfolio characteristics shown relate to the Aristotle Atlantic Focus Growth strategy. Not every client’s account will have these characteristics. Aristotle Atlantic reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Atlantic’s Focus Growth Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Atlantic does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Atlantic Partners, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Atlantic, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. AAP-2501-42

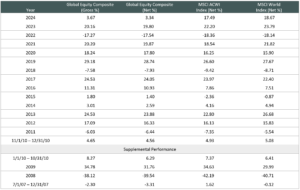

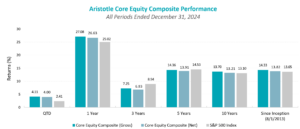

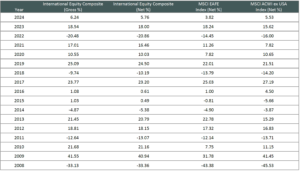

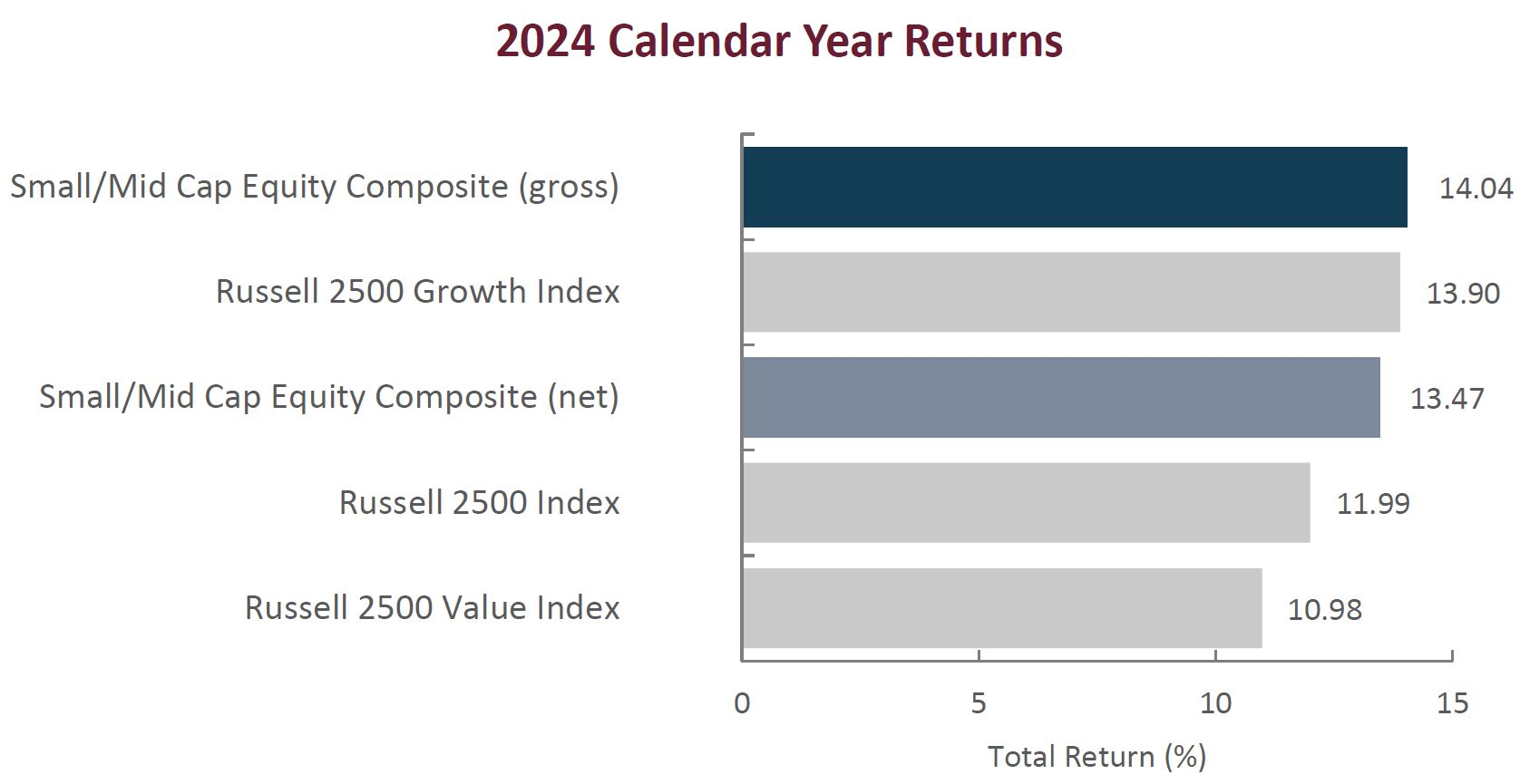

Sources: CAPS CompositeHubTM

Composite returns for all periods ended December 31, 2024 are preliminary pending final account reconciliation.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. This index has been selected as the benchmark and is used for comparison purposes only. The Russell 1000® Value Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Dow Jones Industrial Average® is a price-weighted measure of 30 U.S. blue-chip companies. The Index covers all industries except transportation and utilities. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite includes over 3,000 companies, more than most other stock market indices. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment grade bonds, including corporate, government and mortgage-backed securities. The WTI Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil consumed in the United States. The 3-Month U.S. Treasury Bill is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of three months. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors. The volatility (beta) of the Composite may be greater or less than its respective benchmarks. It is not possible to invest directly in these indices.