Markets Review

Sources: CAPS CompositeHubTM, Bloomberg

Past performance is not indicative of future results. Aristotle Value Equity Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Capital Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

The U.S. equity market ended the year on a strong note, with the S&P 500 Index rising 2.41% during the period. In contrast, the Bloomberg U.S. Aggregate Bond Index declined, falling 3.06% for the quarter.

From a style perspective, the Russell 1000 Value Index underperformed its growth counterpart by 9.05%. As value lagged, nine out of the eleven sectors within the Russell 1000 Value Index posted negative returns. The worst-performing sectors were Materials, Health Care and Real Estate, while Financials and Communication Services were the only sectors to generate positive returns and Information Technology declined the least.

The U.S. economy continued to demonstrate resilience, with real GDP growing at an annualized rate of 3.1%, according to the BEA’s most recent report. Increases in consumer spending, exports, nonresidential fixed investment and federal government spending drove the economic expansion. Retail sales rose 3.8% year-over-year in November, supported by a 2.7% increase in disposable personal income for the most recent quarter.

The labor market remained tight but showed signs of softening, as the unemployment rate edged up to 4.2% in November. Inflation remained relatively stable, rising modestly to an annual rate of 2.7%, as measured by the Consumer Price Index (CPI).

As was widely expected, the Federal Reserve (Fed) implemented two rate cuts during the quarter, setting the federal funds target rate at 4.25% to 4.50%. Fed Chair Jerome Powell emphasized the importance of finding a balance—reducing policy restraint too rapidly could hinder progress on inflation, while acting too slowly could weaken economic activity and the labor market. Still, he indicated that both the economy and monetary policy are on solid footing.

Corporate earnings also showed strength, as S&P 500 companies reported 5.8% earnings growth, marking the fifth consecutive quarter of positive results. A majority of companies exceeded EPS expectations, with only 61 companies issuing negative EPS guidance—the lowest figure since the fourth quarter of 2021. Looking ahead to 2025, consensus estimates project earnings growth of 14.8% for the calendar year, signaling optimism among analysts.

On the political front, Donald Trump was elected as the 47th president of the United States, becoming the first Republican to win the popular vote since 2004. The Republican Party also won the Senate and kept control of the House of Representatives, though with narrow majorities.

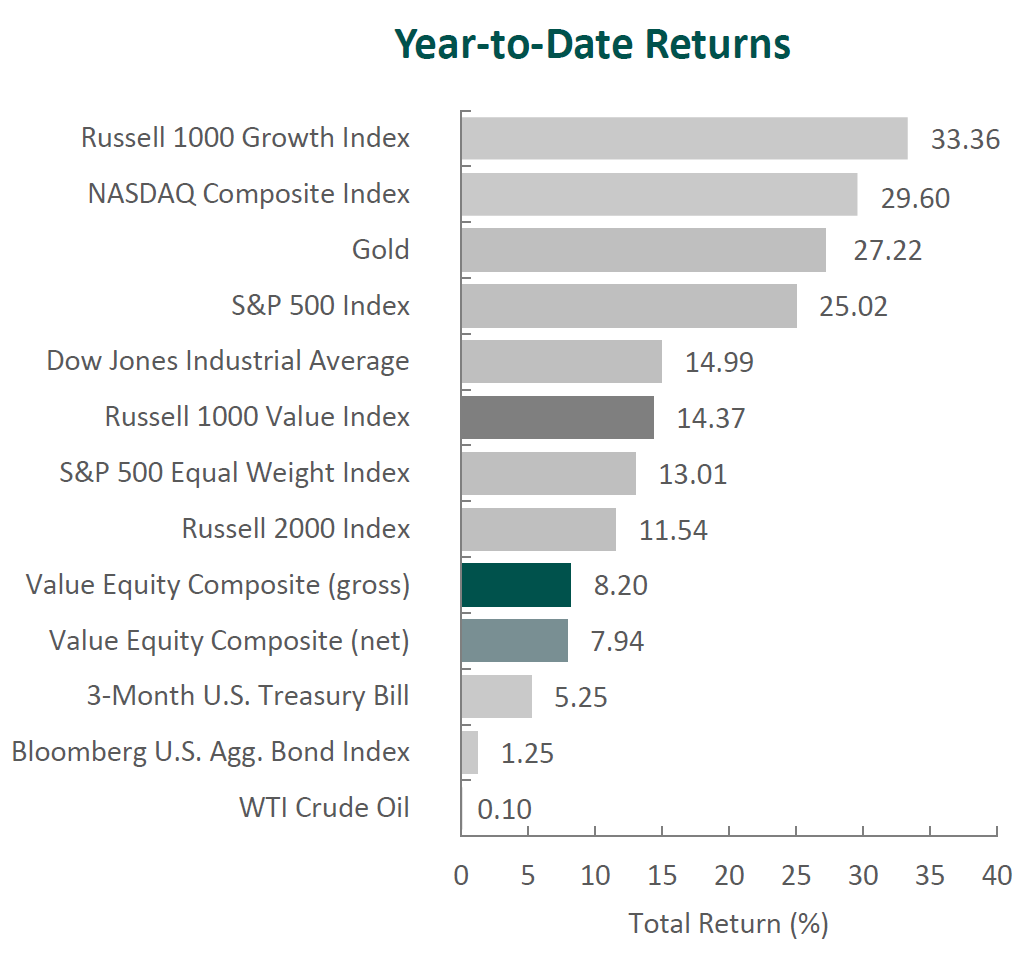

Annual Markets Review

The U.S. equity markets maintained their strong momentum in 2024, with the S&P 500 Index posting a full-year return of 25.02%, while the S&P 500 Equal Weight Index gained just 13.01%. Similar to last year, the market’s gains were heavily driven by the “Magnificent 7,” which now have a collective weight of 33.5% within the S&P 500 Index and accounted for more than half of the Index’s total return. Relatedly, the Russell 1000 Growth Index outperformed the Russell 1000 Value Index by 18.99% for the year. The fixed income market experienced a modest gain, with the Bloomberg U.S. Aggregate Bond Index advancing 1.25% in 2024.

Market headlines throughout the year focused on key economic indicators, including growth, inflation, labor market conditions and the Federal Reserve’s monetary policy decisions. The U.S. presidential election and rising geopolitical conflicts further captured investor attention. But above all, we believe markets in 2024 were captivated by a singular theme: artificial intelligence. In our investment team’s decades of experience, we have observed narrow markets driven by a singular narrative. While we own several high-quality technology companies, some did not participate in the AI-driven rally and therefore underperformed. It is not uncommon for our long-term approach (focused on fundamentals and unfolding catalysts measured in years, not quarters) to underperform when the herd is focused on one dominant theme. Just as we remain grounded during years of outperformance, we stay disciplined and patient during inevitable periods of underperformance. Our history shows that over longer horizons—e.g., three- and five-year periods—our approach has a greater potential to deliver outperformance.

Performance and Attribution Summary

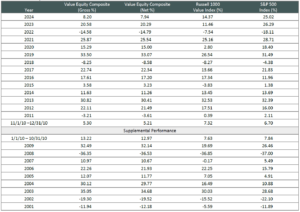

For the fourth quarter of 2024, Aristotle Capital’s Value Equity Composite posted a total return of -4.09% gross of fees (-4.14% net of fees), underperforming the -1.98% return of the Russell 1000 Value Index and the 2.41% return of the S&P 500 Index. Please refer to the table for detailed performance.

| Performance (%) | 4Q24 | 1 Year | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|

| Value Equity Composite (gross) | -4.09 | 8.20 | 3.68 | 10.09 | 11.47 |

| Value Equity Composite (net) | -4.14 | 7.94 | 3.42 | 9.82 | 11.14 |

| Russell 1000 Value Index | -1.98 | 14.37 | 5.63 | 8.68 | 8.49 |

| S&P 500 Index | 2.41 | 25.02 | 8.94 | 14.53 | 13.10 |

Source: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income.

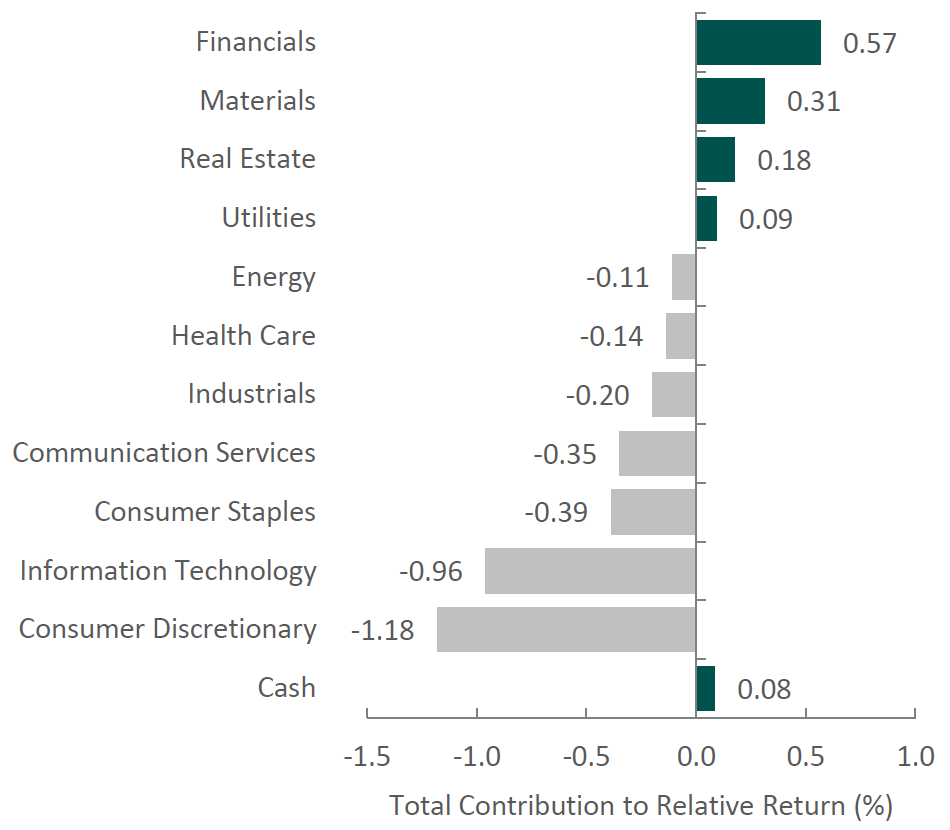

The portfolio’s underperformance relative to the Russell 1000 Value Index in the fourth quarter can be primarily attributed to security selection, while allocation effects also had a slightly negative impact. Security selection in Consumer Discretionary and Information Technology and an overweight in Materials detracted the most from relative performance. Conversely, security selection in Materials and Financials and an underweight in Health Care contributed. (Relative weights are the result of bottom-up security selection.)

Contributors and Detractors for 4Q 2024

| Relative Contributors | Relative Detractors |

|---|---|

| Ameriprise Financial | Lennar |

| Capital One Financial | Microchip Technology |

| Blackstone | Amgen |

| Cullen/Frost Bankers | Adobe |

| Mitsubishi UFJ Financial | Michelin |

Lennar, one of the nation’s largest homebuilders, was the biggest detractor for the quarter. The rapid and unexpected increase in mortgage rates during the quarter resulted in new orders being below prior guidance. As the company attempted to offset the higher mortgage rates’ impact on affordability through short-term incentives, gross margins also suffered. Lennar remains committed to its volume-based strategy and plans to continue to use dynamic pricing and digital marketing to drive sales. Longer term, the underlying demand for homes remains very strong, while the chronic supply shortage continues (the result of years of underproduction and restricted land permitting). In addition to focusing on volume, Lennar also continues to execute on the previously identified catalyst of shifting toward an asset-light, land-light business model (i.e., 82% of land controlled via options versus 18% owned, an improvement from 76/24 just one year ago) and remains open to opportunistic acquisitions, such as the recently announced acquisition of Rausch Coleman Homes, which will expand Lennar’s footprint in Arkansas, Kansas and Missouri.

Microchip Technology, the microcontroller (MCU) and analog semiconductor producer, was one of the largest detractors for the period. Revenues continued to decline amid the severe inventory correction, which has persisted in most end markets other than defense and aerospace since early 2023. In addition, Microchip’s board unexpectedly announced that CEO Ganesh Moorthy (who led the company since 2021) would retire with the current chairman and long-tenured former CEO Steve Sanghi returning. Mr. Sanghi returned on an interim basis, allowing the company to focus on turnaround efforts without near-term plans to search for a replacement. We have admired Mr. Sanghi’s skill at navigating past chip cycles and will closely track the company’s ability to execute on restructuring initiatives, which aim to resize its manufacturing footprint and reduce inventory. This includes plans to soon shut down the company’s wafer fabrication facility in Arizona, which the company expects should generate annual cash savings of approximately $90 million. Despite recent missteps in inventory management that were exacerbated by cyclical headwinds, we are optimistic about management’s plans to right-size its business. Moreover, we remain confident that Microchip’s broad portfolio is uniquely positioned to increase its market share in 16- and 32-bit MCUs and areas including IoT, 5G infrastructure, autonomous driving and data centers.

Ameriprise Financial, the asset and wealth manager, was the top contributor for the quarter. The company benefited from rising equity markets and client inflows, with total assets under management and administration up 22%. Wealth management reported $8.6 billion in client net inflows during the quarter, bringing its total client assets to a record high, passing the $1 trillion mark. During our time as shareholders, Ameriprise has continued to execute on its shift toward fee-based, lower capital-intensive financial advice and asset management businesses (and away from insurance products). Today the Advice & Wealth Management segment, combined with the Asset Management segment, account for over 80% of the company’s revenues. This has served to unlock excess capital (of which it returned $713 million to shareholders during the third quarter). In addition, the company takes pride in its ability to attract and retain financial advisors, providing them tools and technology that allow them to be more productive and to better serve their clients. As a testament to its success, the company boasted a record 21 advisors ranked in the most recent Barron’s Top 100 Independent Financial Advisors list. Moreover, we believe the firm’s diversified model and strong balance sheet should allow it to continue to invest for future business growth while returning capital to shareholders over the long term ($11.9 billion returned to shareholders over the past five years).

Capital One Financial was a top contributor to performance during the quarter. There is now an increased likelihood its proposed $35 billion acquisition of Discover Financial Services will close in 2025. The deal, designed to create the largest credit card issuer in the U.S., initially faced scrutiny from the Biden-Harris administration due to antitrust concerns. However, Donald Trump’s election victory raised expectations for a more favorable regulatory environment under the new administration. If completed, the acquisition would make Capital One the sixth-largest bank and the second-largest credit card issuer by purchase volume in the U.S. Gaining Discover’s network—which is as widely accepted domestically as Visa, Mastercard and American Express—would enhance Capital One’s ability to streamline operations and capture greater value across a larger customer base as consumers increasingly shift from cash to digital payments.

Recent Portfolio Activity

| Buys | Sells |

|---|---|

| None | None |

Consistent with our long-term horizon and low turnover, there were no new purchases or sales completed during the quarter.

Conclusion

While our absolute returns in 2024 were in line with long-term averages, our portfolio’s relative performance was disappointing. Despite this, we remain confident in our time-tested investment process which has a longer-term orientation. By definition, value investors often seek to invest in companies that are not “in vogue” with investors. As a result, we believe our quality oriented approach to intrinsic value investing is best measured over a full market cycle, which we define as three to five years. While the market in 2024 was largely driven by narrowly focused investment themes, we remain confident that, over the long term, stock prices will track business fundamentals.

The opinions expressed herein are those of Aristotle Capital Management, LLC (Aristotle Capital) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to purchase or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Capital makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle Value Equity strategy. Not every client’s account will have these characteristics. Aristotle Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Capital’s Value Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Capital does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Capital Management, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Capital, including our investment strategies, fees and objectives, can be found in our ADV Part 2, which is available upon request. ACM-2501-28

Composite returns for all periods ended December 31, 2024 are preliminary pending final account reconciliation.

Past performance is not indicative of future results. The information provided should not be considered financial advice or a recommendation to purchase or sell any particular security or product. Performance results for periods greater than one year have been annualized. The Aristotle Value Equity strategy has an inception date of November 1, 2010; however, the strategy initially began at Mr. Gleicher’s predecessor firm in October 1997. A supplemental performance track record from January 1, 2001 through October 31, 2010 is provided above. The returns are based on two separate accounts and performance results are based on custodian data. During this time, Mr. Gleicher had primary responsibility for managing the two accounts, one account starting in November 2000 and the other December 2000.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The Russell 1000 Value® Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The S&P 500 Equal Weight Index is designed to be the size-neutral version of the S&P 500. It includes the same constituents as the cap-weighted S&P 500, but each company in the S&P 500 Equal Weight Index is allocated the same weight at each quarterly rebalance. The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Dow Jones Industrial Average® is a price-weighted measure of 30 U.S. blue-chip companies. The Index covers all industries except transportation and utilities. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite includes over 3,000 companies, more than most other stock market indexes. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment grade bonds, including corporate, government and mortgage-backed securities. The WTI Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil consumed in the United States. The 3-Month U.S. Treasury Bill is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of three months. The Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The volatility (beta) of the Composite may be greater or less than its respective benchmarks. It is not possible to invest directly in these indexes.