Commentary

Core Equity 3Q 2023

Markets Review

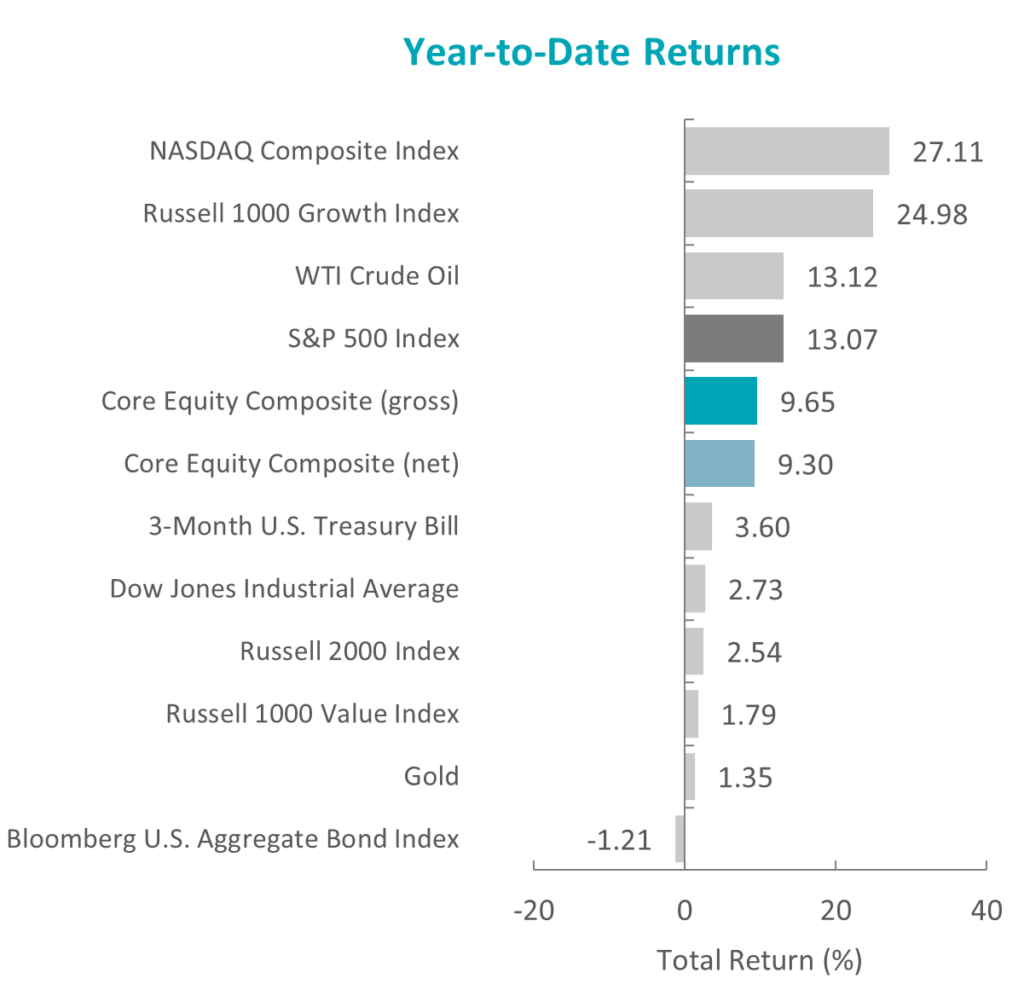

After three consecutive positive quarters, the U.S. equity market pulled back, as the S&P 500 Index declined 3.27% during the quarter. Concurrently, the Bloomberg U.S. Aggregate Bond Index also fell, dropping 3.23% for the quarter. In terms of style, the Russell 1000 Growth Index slightly outperformed its value counterpart by 0.03%

Declines were broad-based, as nine out of the eleven sectors within the S&P 500 Index finished lower for the quarter. Utilities, Real Estate and Consumer Staples were the worst-performing sectors. Meanwhile, Energy and Communication services were the only two sectors in the green, and Financials declined the least.

Sources: CAPS CompositeHubTM, Bloomberg

Past performance is not indicative of future results. Aristotle Atlantic Core Equity Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Atlantic Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Economic growth in the U.S. remained steady, as data released during the quarter showed real GDP increased at an annual rate of 2.1%. The increase was driven by higher levels of consumer and government spending, as well as nonresidential fixed investment. The labor market remained tight during the period, with a 3.8% unemployment rate in August, while average hourly earnings for all employees increased by 4.3% year-over-year.

There was an uptick in inflation reported during the quarter, as annualized CPI increased from 3.0% in June to 3.7% in August. In addition, oil hit its highest level of the year, with both WTI and Brent eclipsing $90 a barrel. Given the concerns about rebounding inflation, 10-year and 30-year Treasury yields spiked to their highest marks since 2007 and 2011, finishing the quarter at 4.59% and 4.73%, respectively. However, the broader trend of disinflation continues, as the 3.7% August CPI figure is still less than half the 8.3% increase the Index experienced the year prior.

After raising its benchmark federal funds rate to a range of 5.25% to 5.50% in July, the Federal Reserve (Fed) held interest rates steady in September, citing a solid pace of expanding economic activity, a slightly softer—yet still strong—labor market and tighter credit conditions. The Fed indicated that it would continue to monitor cumulative monetary policy, the lagged effects of policy decisions, and economic and financial developments when determining the extent of additional rate increases.

On the corporate earnings front, S&P 500 companies reported a 4.1% decline in earnings, the third straight quarter that saw a year-over-year decrease. Despite the drop, fewer companies discussed “recession” and “inflation” during the reporting period. Furthermore, aggregate earnings estimates for the third quarter increased by 0.4% (above the 10-year average of -3.4%), the first increase in nearly two years.

Performance and Attribution Summary

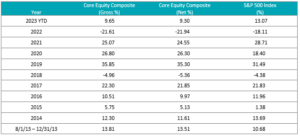

For the third quarter of 2023, Aristotle Atlantic’s Core Equity Composite posted a total return of -4.87 % gross of fees (-4.98% net of fees), underperforming the S&P 500 Index, which recorded a total return of -3.27%.

| Performance (%) | 3Q23 | YTD | 1 Year | 3 Years | 5 Years | 7 Years | Since Inception* |

|---|---|---|---|---|---|---|---|

| Core Equity Composite (gross) | -4.87 | 9.65 | 17.37 | 7.13 | 9.20 | 12.17 | 12.17 |

| Core Equity Composite (net) | -4.98 | 9.30 | 16.87 | 6.68 | 8.75 | 11.65 | 11.65 |

| S&P 500 Index | -3.27 | 13.07 | 21.62 | 10.15 | 9.91 | 11.91 | 11.72 |

Source: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income. Please see important disclosures at the end of this document.

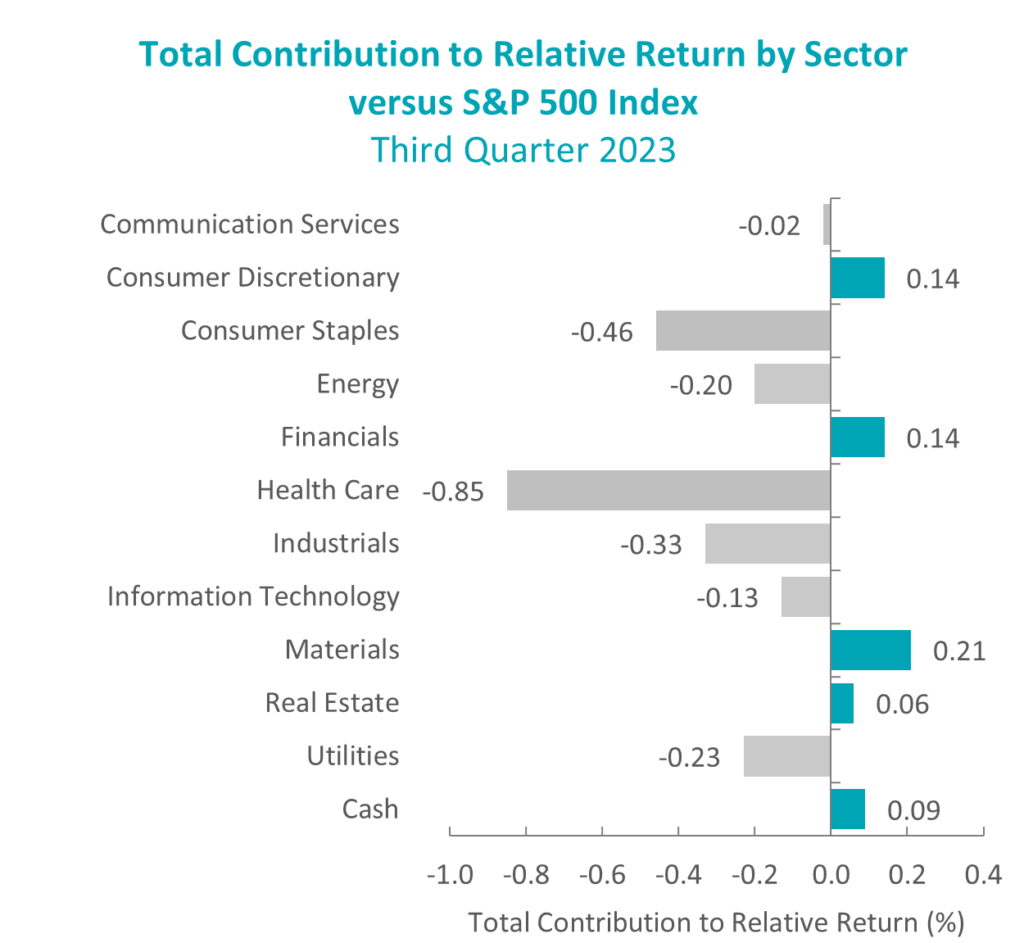

During the third quarter, the portfolio’s underperformance relative to the S&P 500 Index was due to both security selection and allocation effects. Security selection in Health Care, Consumer Staples and Industrials detracted the most from relative performance. Conversely, security selection in Materials, Financials and Communication Services contributed to relative performance.

Contributors and Detractors for 3Q 2023

| Relative Contributors | Relative Detractors |

|---|---|

| Halliburton | Darling Ingredients |

| Chubb | Spirit AeroSystems |

| Avery Dennison | Bio-Techne |

| Marriott International | Dollar General |

| Trane Technologies | Teleflex |

Contributors

Halliburton

Halliburton contributed to outperformance in the quarter. The company continues to benefit from higher commodity prices, with both oil and natural gas prices increasing due to supply concerns, as well as improving supply-demand fundamentals in 2024. Investors are focusing on the upside growth benefits to the company in 2024, as North American oil and gas producers begin to increase rig counts, and international oil companies (IOCs) and national oil companies (NOCs) continue to increase their spending on mega projects. Halliburton should see a reacceleration in topline growth and improved margins as the result of the company’s focus over the last few years on higher-margin tools and technology offerings.

Chubb

Chubb contributed to outperformance due to sustained momentum across business units and global regions, a favorable property and casualty (P&C) rate environment and an attractive valuation with shares trading below historical averages. The company’s earnings report early in the quarter highlighted its underwriting and risk-assessment capabilities, with management projecting a continuation of what we believe are positive pricing trends through the remainder of this year.

Detractors

Darling Ingredients

Darling Ingredients shares were weak in the third quarter after the company reported an inline quarter and reaffirmed guidance for the fourth quarter. Diamond Green Diesel had a planned downtime in July when an unexpected fire resulted in 10 days of no production in Norco Los Angeles later in the quarter. Higher interest rates this month pressured companies with outsized leverage, such as Darling Ingredients, and they are working on deleveraging following several acquisitions last year.

Spirit AeroSystems

Spirit AeroSystems underperformed in the third quarter. The company reported disappointing earnings in August. Additionally, the company reported its second manufacturing quality issue on its most important aircraft program, the 737 MAX which should result in additional costs to the company and a delay in revenue recognition on the program. The company is also experiencing manufacturing issues on the Boeing 787, Airbus A220 and A350 that need to be resolved with Boeing and Airbus, respectively. After the end of the quarter, the CEO was replaced, which we view as a positive development.

Recent Portfolio Activity

The table below shows all buys and sells completed during the quarter, followed by a brief rationale.

| Buys | Sells |

|---|---|

| Oracle | Microchip Technology |

| Meta Platforms | Dollar General |

Buys

Oracle

Oracle provides products and services that address enterprise information technology (IT) environments. The company’s products and services include enterprise applications and infrastructure offerings that are delivered worldwide through a variety of flexible and interoperable IT deployment models. The company operates in three segments: cloud and license business, hardware, and services.

We believe Oracle’s cloud infrastructure product, OCI 2.0, continues to demonstrate strong revenue growth over several quarters. Additionally, we see the rapid growth of artificial intelligence (AI) computing needs as being a differentiated growth driver for Oracle. We believe that Oracle will continue to drive positive outcomes for the Cerner business through a better margin structure, as well as topline sales synergies.

Meta Platforms

Meta Platforms, formerly known as Facebook, is a global technology company specializing in social networking and the development of augmented and virtual reality technologies. Founded in 2004 and headquartered in Menlo Park, CA, the company has expanded its reach to nearly three billion monthly active users worldwide.

We see Meta as well-positioned to capture a significant share of the rapidly growing digital advertising market and has created an interconnected ecosystem of apps that drives higher user engagements. While leveraging AI and machine learning technology, Meta should see an acceleration in the development of targeted digital advertising capabilities and enhance the user experience across its platform. We see near-term catalysts in Rising Reels and Messenger revenue monetization and an expected robust 2024 political and Olympic advertising. Year-to-date, investors have been optimistic about the company’s pivot away from a focus on metaverse investments to an emphasis on profitability and growth in what the company calls its “Year of Efficiency.”

Sells

Microchip Technology

We sold Microchip Technology and moved to an equal weight in the semiconductor subsector. We expect to see a couple more quarters of volatility in many of the end markets that the company sells into and expect inventory levels to remain elevated, forcing lower sell-through than expected.

Dollar General

We sold Dollar General following the company’s earnings report where same-store sales fell 0.1%, which was below expectations. The company cited the deteriorating macro environment affecting an already challenged consumer, including an unanticipated impact from reductions in federal food stamp programs (SNAP) and lower tax refunds. The company lowered its full-year guidance, as the company continues to invest in price, wages and supply chain initiatives. The shifting mix towards lower-margin consumables versus higher-margin discretionary items in store continues to hamper margins. Comparable sales are expected to be negative in the third quarter and improving in the fourth quarter on easing comparisons. Given Dollar General’s commitment to investing in growth initiatives, margin recovery could be delayed versus management’s plans.

Outlook

The equity markets in the third quarter were negatively impacted by a steep rise in interest rates. The move in interest rates reflects the outlook that the Fed will have to keep rates higher for longer to get inflation under control. Rising oil prices did not help the inflation outlook but did result in pushing the Energy sector into positive territory and making the sector the best performer for the period. The consumer is now facing higher gasoline prices at the pump, and those with student loans are now faced with renewed interest payments due to the failed attempt to forgive student debt. This has resulted in an increased probability of slower economic growth due to these challenges. The one bright spot continues to be the strong backlog of orders in the industrial segment of the economy. We have yet to see a material benefit from the recently passed legislative packages that could extend and add to these backlogs. We are now entering a period where the economy should show signs of slowing given the duration and severity of rate hikes on the part of the Fed. The equity markets may very well welcome bad economic news as a sign that the rate cycle is finally coming to an end. Our focus will continue to be at the company level, with an emphasis on seeking to invest in companies with secular tailwinds or strong product-driven cycles.

The opinions expressed herein are those of Aristotle Atlantic Partners, LLC (Aristotle Atlantic) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to purchase or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Atlantic makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle Atlantic Core Equity strategy. Not every client’s account will have these characteristics. Aristotle Atlantic reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Atlantic’s Core Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Atlantic does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Atlantic Partners, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Atlantic, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. AAP-2310-32

Sources: CAPS Composite Hub, Russell Investments

Composite returns for all periods ended September 30, 2023 are preliminary pending final account reconciliation.

The Aristotle Core Equity Composite has an inception date of August 1, 2013 at a predecessor firm. During this time, Mr. Fitzpatrick had primary responsibility for managing the strategy. Performance starting November 1, 2016 was achieved at Aristotle Atlantic.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. This index has been selected as the benchmark and is used for comparison purposes only. The Russell 1000® Value Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Dow Jones Industrial Average® is a price-weighted measure of 30 U.S. blue-chip companies. The Index covers all industries except transportation and utilities. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite includes over 3,000 companies, more than most other stock market indices. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment grade bonds, including corporate, government and mortgage-backed securities. The WTI Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil consumed in the United States. The Brent Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. The 3-Month U.S. Treasury Bill is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of three months. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors. The volatility (beta) of the Composite may be greater or less than its respective benchmarks. It is not possible to invest directly in these indices.