(All MSCI index returns are shown net and in U.S. dollars unless otherwise noted.)

Markets Review

Sources: CAPS CompositeHubTM, Bloomberg

Past performance is not indicative of future results. Aristotle International Equity ADR Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Capital Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

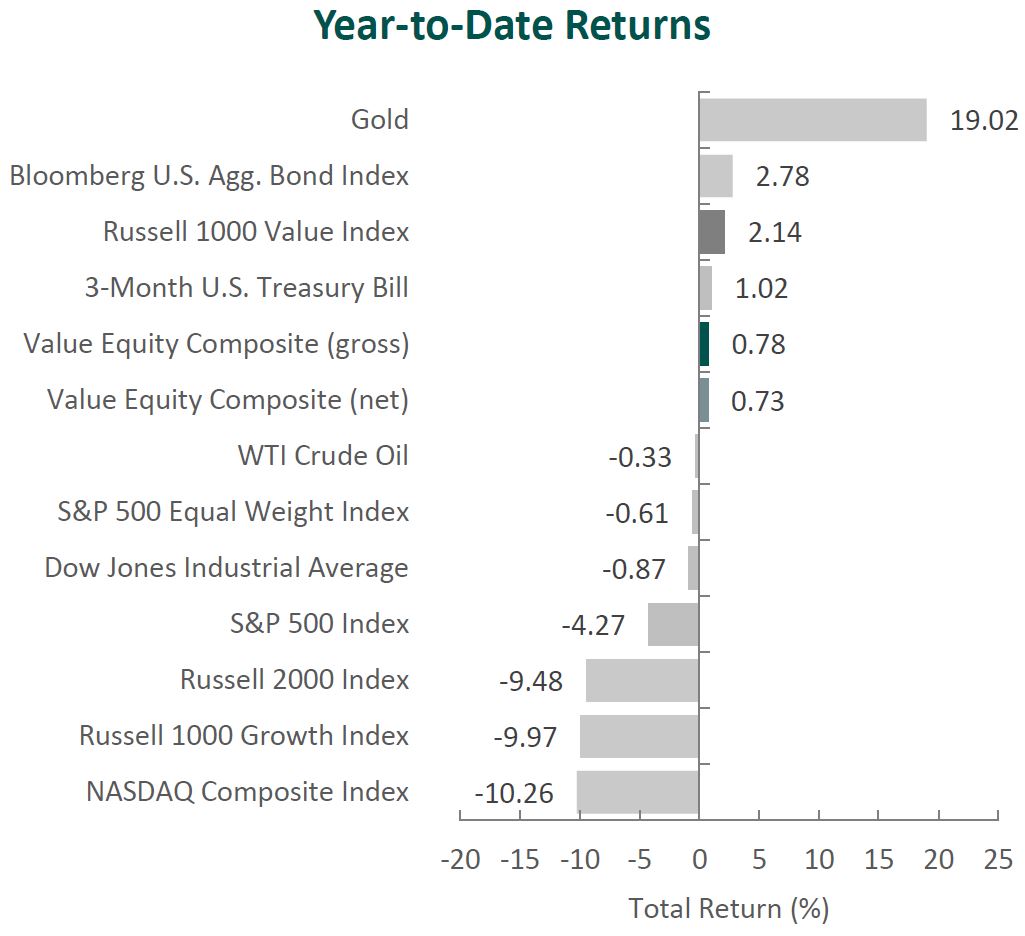

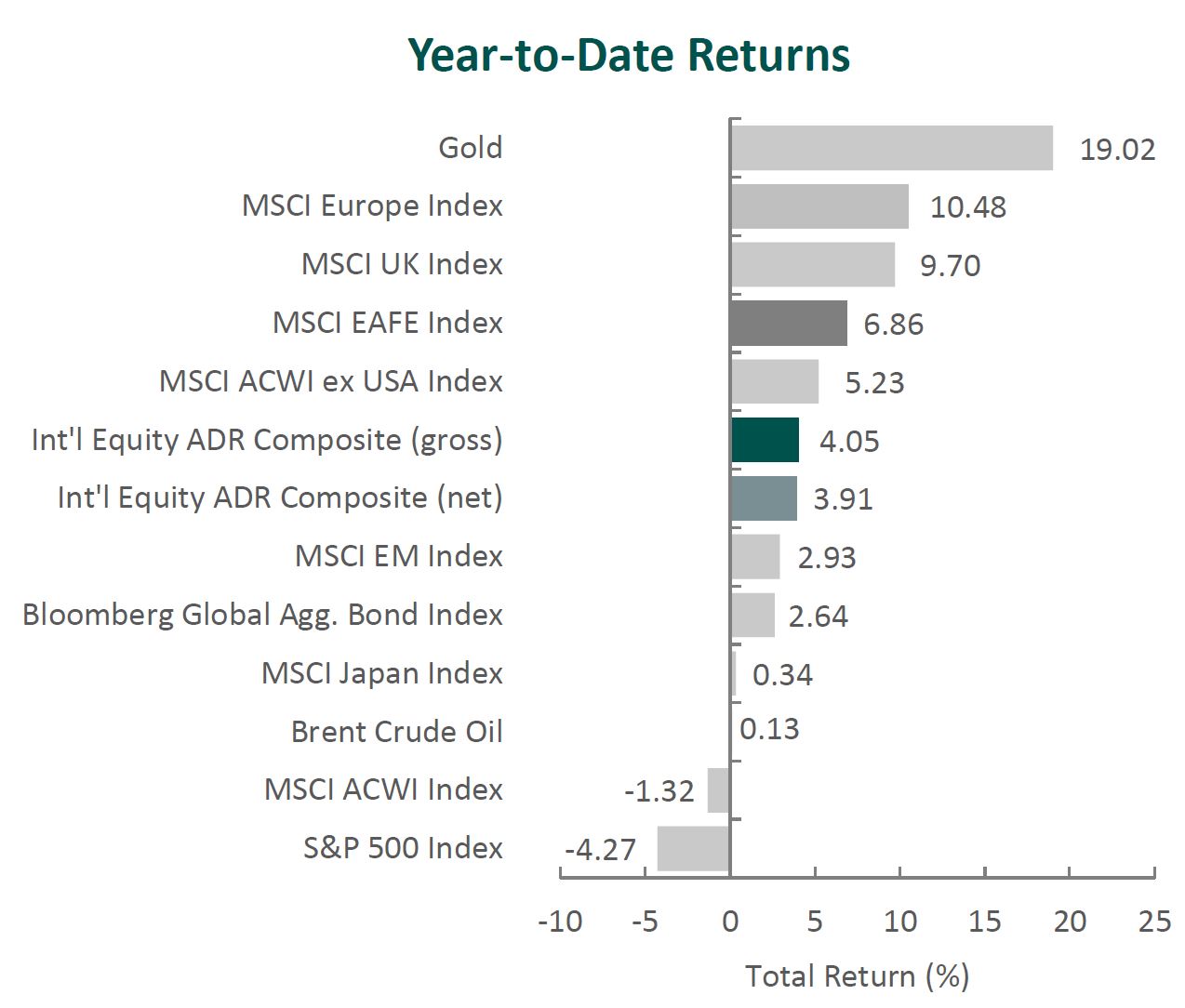

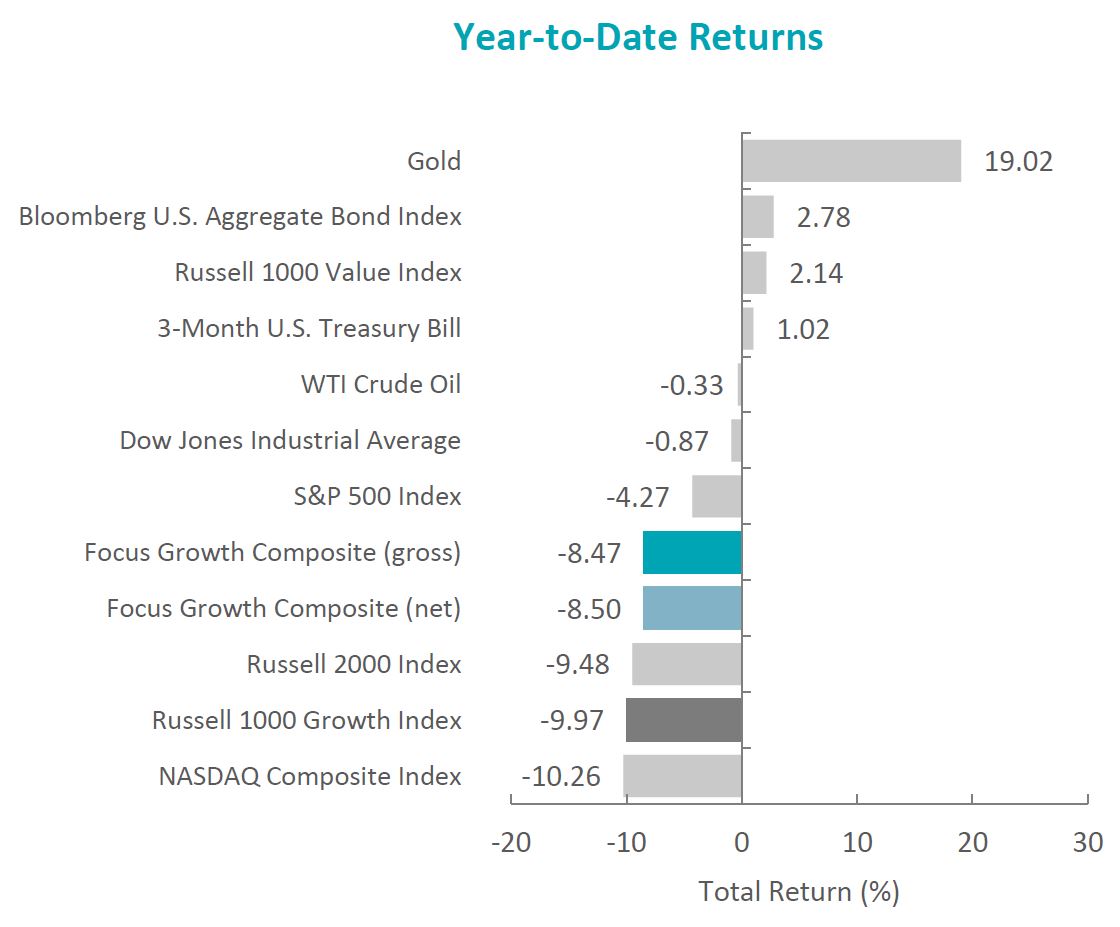

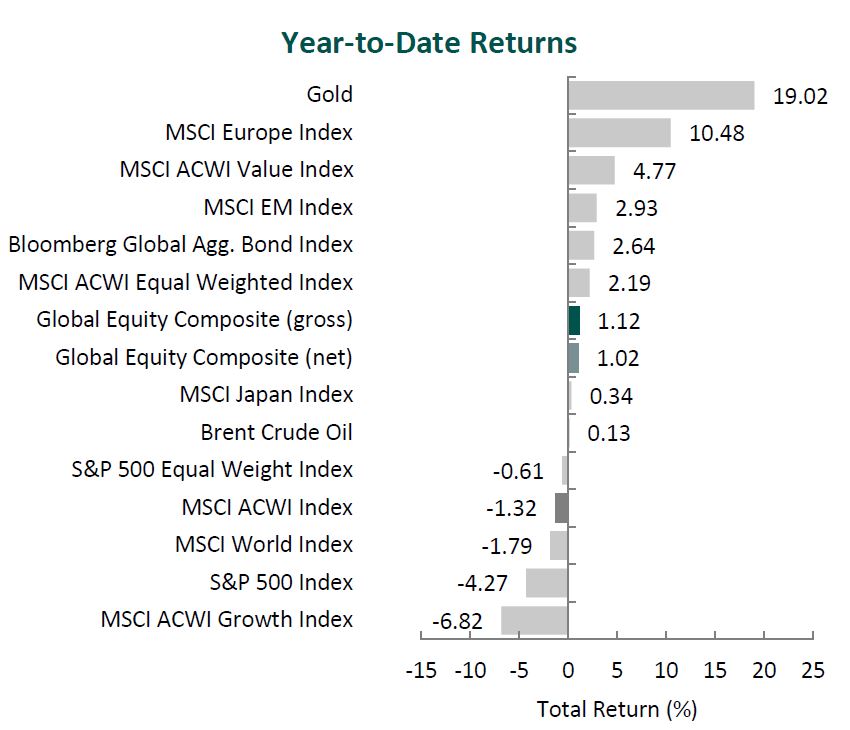

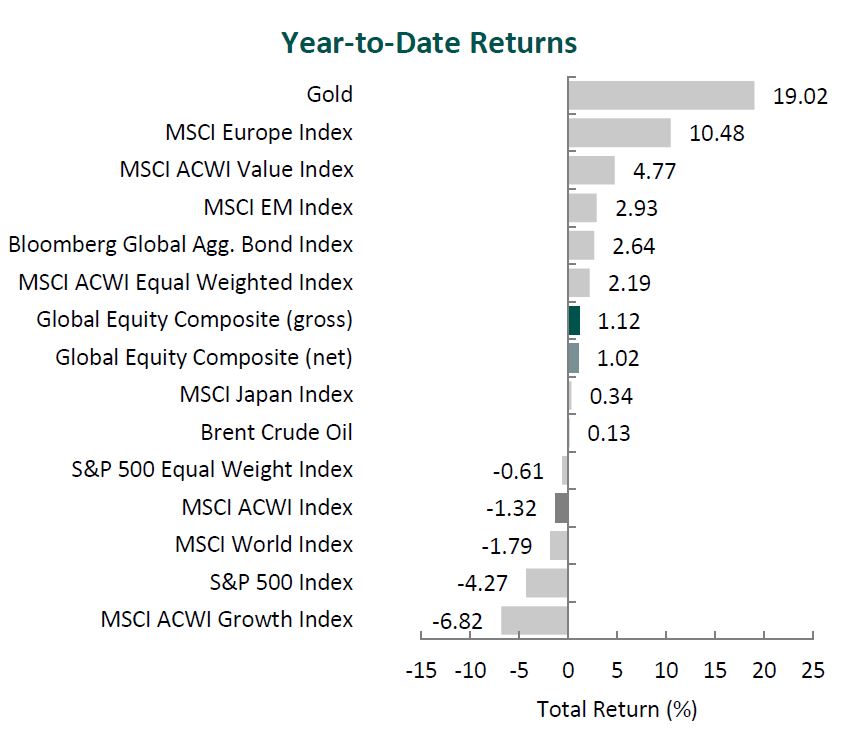

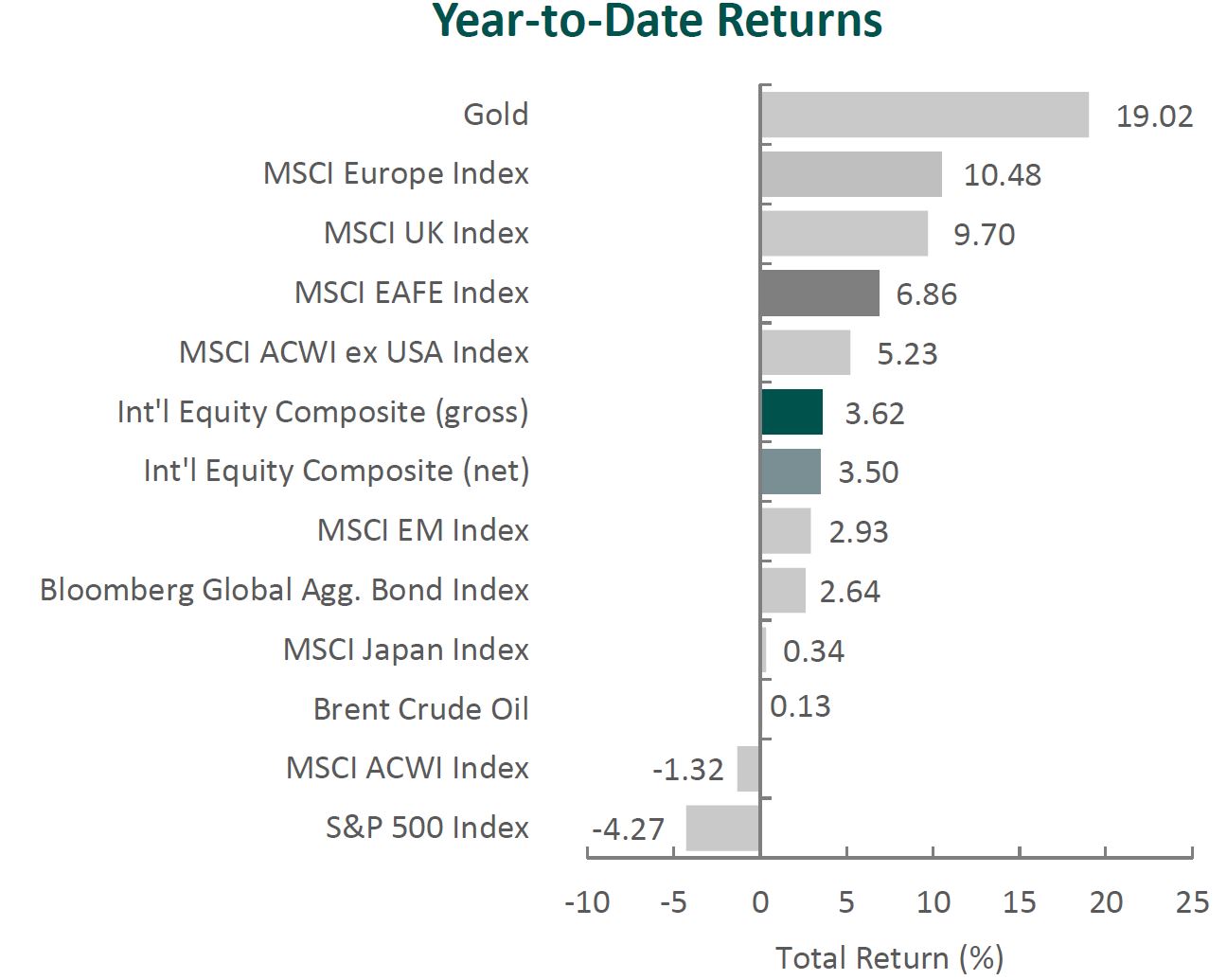

Global equity markets started the year on a modestly negative note, with the MSCI ACWI Index returning ‑1.32% for the first quarter. In contrast, global fixed income gained ground, as the Bloomberg Global Aggregate Bond Index rose 2.64%. Value stocks outpaced growth over the quarter, with the MSCI ACWI Value Index outperforming the MSCI ACWI Growth Index by 11.59%.

Outside the U.S., international equities made strong gains versus their American counterparts. The MSCI EAFE Index rose 6.86% during the first quarter, while the MSCI ACWI ex USA Index climbed 5.23%. Within the MSCI EAFE Index, Europe & Middle East and the U.K. were the strongest performers, while Asia increased the least. On a sector basis, nine out of the eleven sectors within the MSCI EAFE Index posted positive returns, with Energy, Financials and Utilities generating the largest gains. Conversely, Information Technology, Consumer Discretionary and Real Estate performed the worst.

Inflation trends remained broadly stable across developed markets. The U.S., U.K., and EU all reported annual inflation below 3%, giving central banks greater flexibility. The Federal Reserve held rates steady, while the European Central Bank and Bank of England continued to ease monetary policy in response to softer growth signals. In Asia, China’s economy recorded 5% GDP growth in 2024, showing tentative signs of recovery, while the Bank of Japan raised interest rates for the third time since ending its negative interest rate policy in March 2024 on expectations of sustained 2% inflation.

Trade policy re-emerged as a market concern during the quarter. In his first months back in office, President Trump announced a new wave of tariffs on imports from Canada, Mexico and China, with additional warnings directed at the EU and other trading partners over what were termed “imbalanced trade arrangements.” The targeted industries—autos, steel and aluminum—reflected a focus on reshoring and industrial policy. While the long-term impact is still unfolding, the renewed trade uncertainty prompted central banks to lower growth forecasts and adopt a more cautious tone on future rate moves.

In Europe, Germany’s economy remained under pressure after contracting for a second consecutive year in 2024—the first two-year contraction since 2003. In response, Chancellor-designate Friedrich Merz proposed sweeping fiscal reforms, including an overhaul of the constitutional debt brake, a €500 billion infrastructure fund and increased defense spending. While potentially supportive of medium-term growth, these initiatives have raised concerns around inflation and fiscal discipline, adding complexity to the European Central Bank’s policy path.

On the geopolitical front, a fragile ceasefire between Israel and Hamas in January unraveled by March amid disagreements over hostage releases. In Ukraine, a military stalemate in the east opened the door for ceasefire negotiations brokered by the U.S., with discussions reportedly tied to a potential minerals agreement to offset financial aid.

Finally, the artificial intelligence (AI) theme continued to influence market narratives. Chinese startup DeepSeek gained international attention after launching a low-cost rival to leading generative AI models from OpenAI, Anthropic and Google. The move not only intensified competition but raised new questions about the durability and configuration of global AI supply chains. Notably, DeepSeek’s approach—achieving comparable performance at a fraction of the cost—has challenged assumptions around the infrastructure demands of generative AI, potentially reducing the need for GPUs, energy-intensive data centers and the broader hardware stack the market had expected would underpin AI growth.

Performance and Attribution Summary

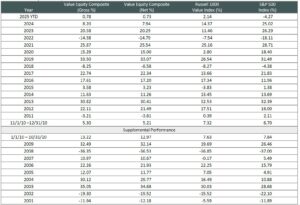

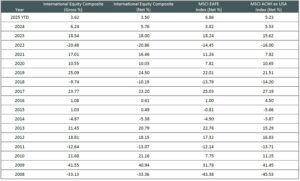

For the first quarter of 2025, Aristotle Capital’s International Equity ADR Composite posted a total return of 4.05% gross of fees (3.91% net of fees), underperforming the MSCI EAFE Index, which returned 6.86%, and the MSCI ACWI ex USA Index, which returned 5.23%. Please refer to the table below for detailed performance.

| Performance (%) | 1Q25 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception* |

|---|---|---|---|---|---|---|

| International Equity ADR Composite (gross) | 4.05 | 7.65 | 6.46 | 13.28 | 6.73 | 6.50 |

| International Equity ADR Composite (net) | 3.91 | 7.12 | 5.91 | 12.72 | 6.22 | 5.99 |

| MSCI EAFE Index (net) | 6.86 | 4.88 | 6.05 | 11.77 | 5.40 | 5.66 |

| MSCI ACWI ex USA Index (net) | 5.23 | 6.09 | 4.48 | 10.92 | 4.98 | 5.01 |

Source: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income.

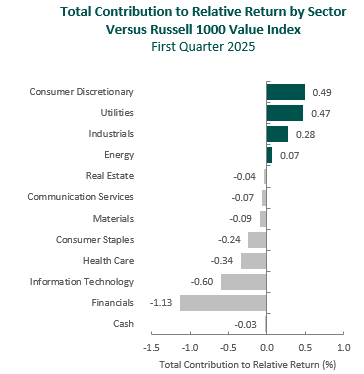

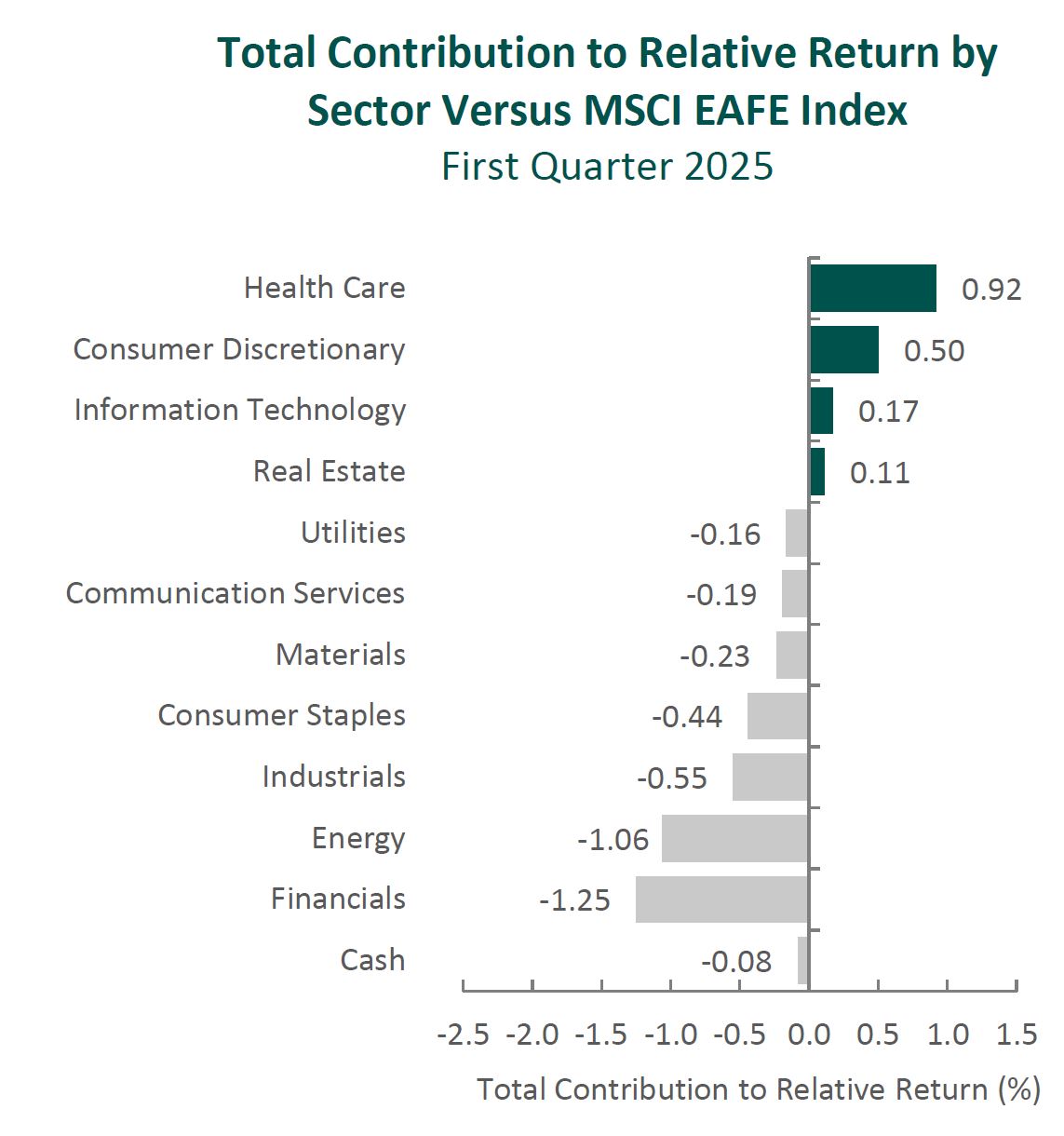

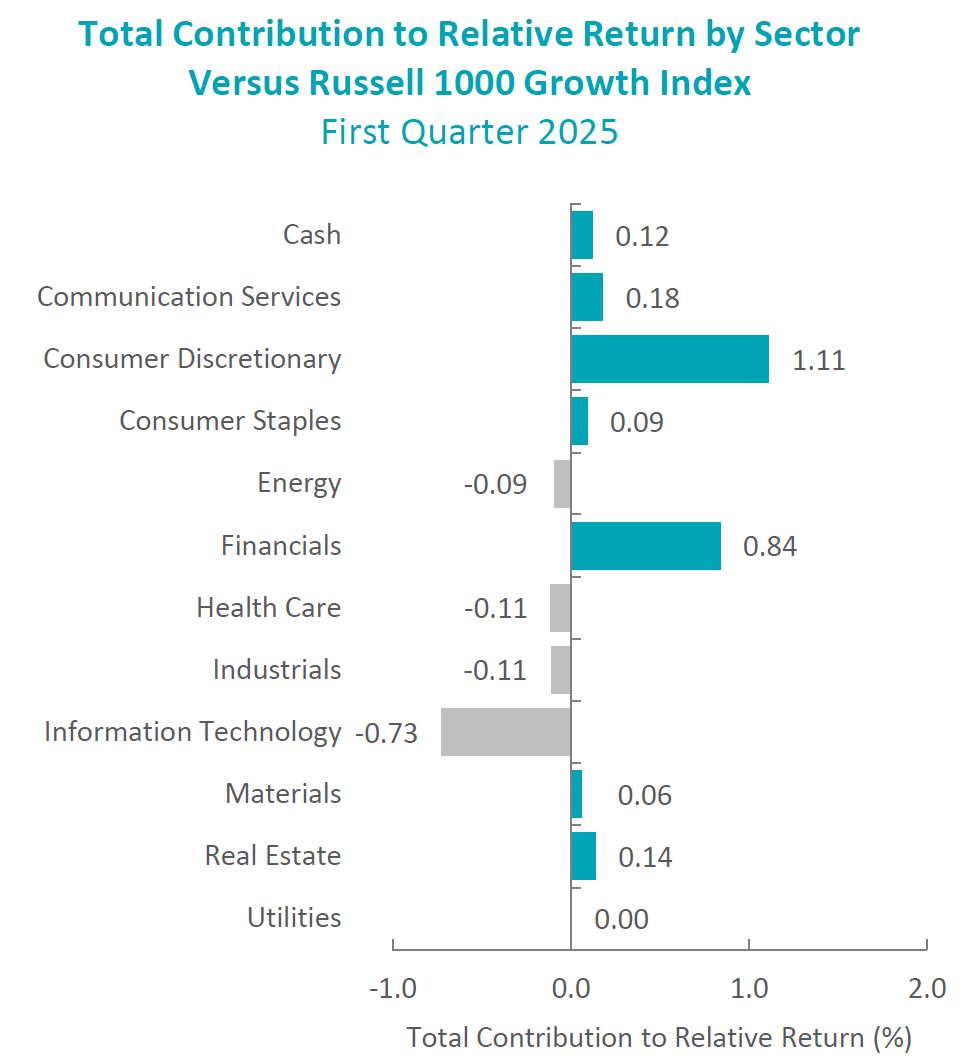

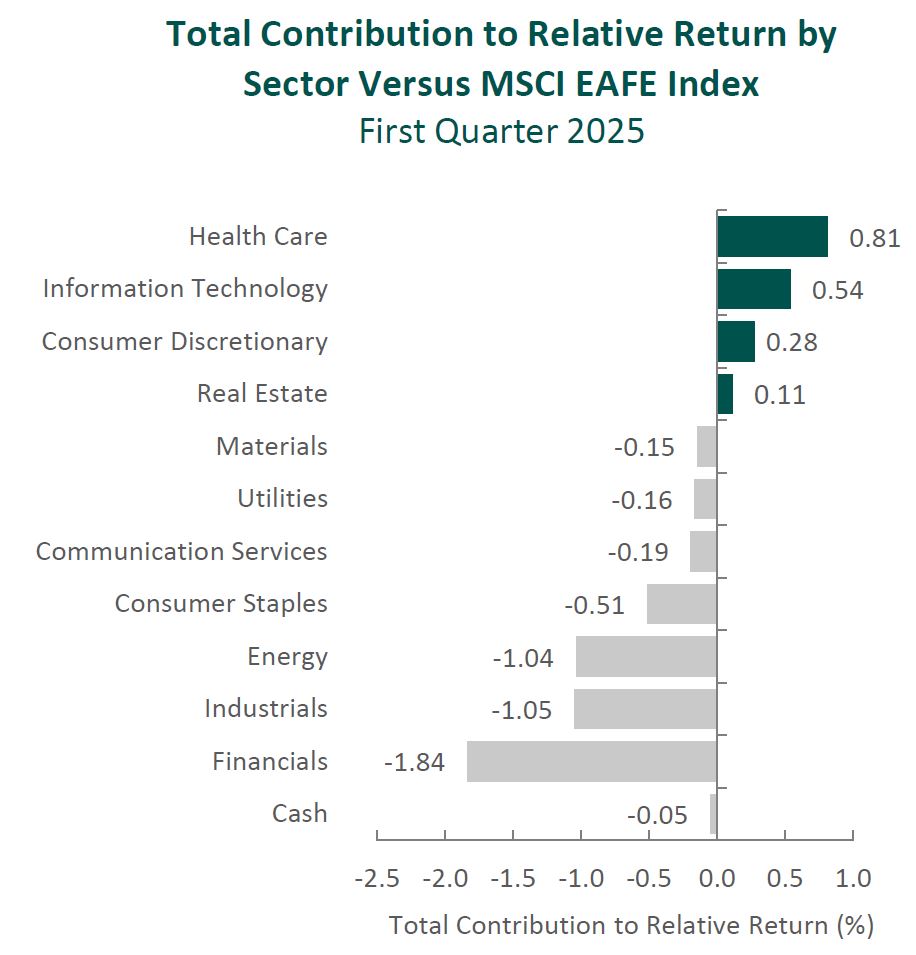

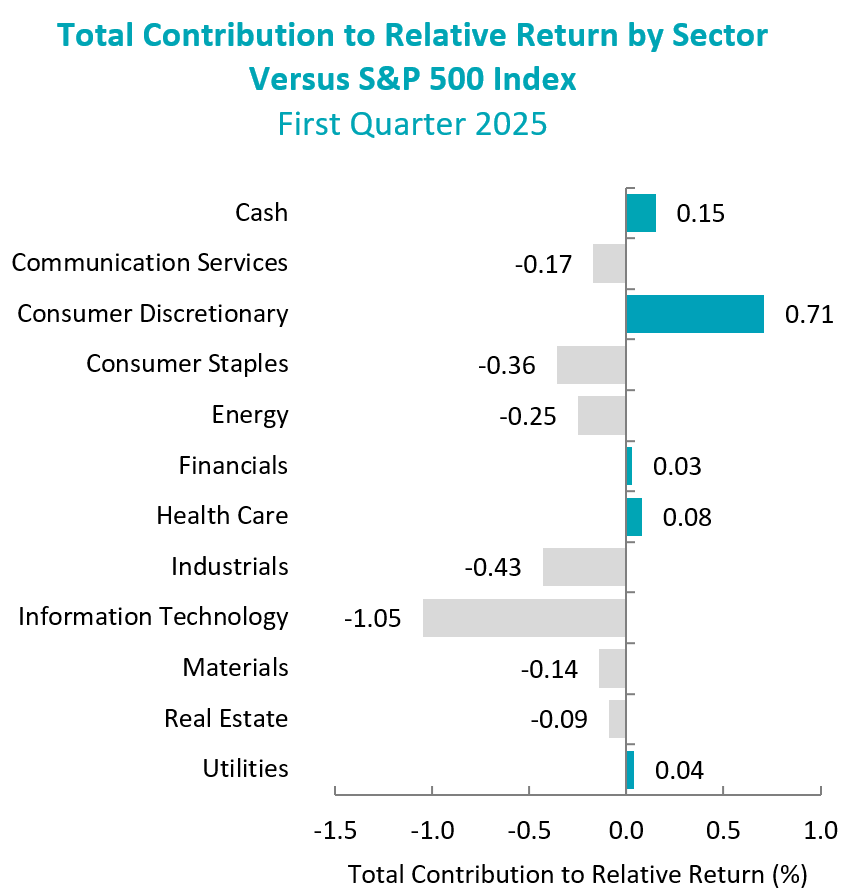

From a sector perspective, the portfolio’s underperformance relative to the MSCI EAFE Index can be attributed to both security selection and allocation effects. Security selection in Energy, Financials and Industrials detracted the most from the portfolio’s relative performance. Conversely, security selection in Health Care and Consumer Discretionary, as well as an underweight in Information Technology, contributed to relative returns.

Regionally, both allocation effects and security selection were responsible for the portfolio’s underperformance. Exposure to Canada and security selection in the U.K. detracted the most from relative performance, while security selection and an underweight in Asia contributed.

Contributors and Detractors for 1Q 2025

| Relative Contributors | Relative Detractors |

|---|---|

| ING Groep | Cameco |

| Safran | Brookfield |

| Munich Reinsurance | Accenture |

| Sony | Diageo |

| Roche | Ashtead Group |

Cameco, one of the world’s largest uranium producers, was a primary detractor during the quarter. Shares of the Canada-based company declined following President Trump’s 10% tariff on Canadian energy exports to the U.S., where Cameco is a major uranium supplier. However, we believe these tariff concerns are overstated given the inelastic nature of uranium demand and the lack of substitutes. Any incremental costs would be absorbed by utilities under existing contract structures. While the company’s stock price may have followed the decline in uranium spot prices during the period, Cameco’s business is largely insulated from short-term price swings due to its extensive use of long-term contracts rather than spot-market sales. Moreover, the company’s tier-one assets in politically stable jurisdictions, operational track record and ability to flex production—particularly at its MacArthur River and Key Lake mines—further strengthen its competitive advantage. We believe Cameco remains exceptionally well-positioned to benefit as governments around the world increasingly turn to nuclear power as a clean, secure and scalable source of energy.

Accenture, the global IT services and consulting firm, was one of the largest detractors during the period. The company reported revenue at the top end of its guided range, supported by solid booking, particularly in large-scale transformational projects from major corporate clients. Despite these results, shares declined as investor sentiment was impacted by continued client caution amid heightened global uncertainty, including concerns around tariffs and consumer sentiment, as well as the U.S. administration’s initiative to streamline federal operations, which could result in canceled or delayed government contracts. We believe Accenture is well-positioned to support the federal government’s efficiency goals through its expertise and proven track record in delivering innovative, cost-effective solutions. Accenture has also continued to see traction in emerging areas such as generative AI, securing $1.4 billion in new bookings and generating approximately $600 million in related revenue during the quarter. Short-term fluctuations in consulting demand are not unusual, and we remain confident that Accenture’s global scale and deep expertise make it well-positioned to continue to provide solutions and deepen its partnerships with many of the world’s largest companies as they continue to implement increasingly sophisticated technologies.

Munich Re, the world’s largest reinsurance company, was a leading contributor for the quarter. The company delivered strong results despite absorbing €1.2 billion in claims from January’s California wildfires, a testament to the reinsurer’s prudent risk management. Demonstrating confidence in its ongoing profitability and robust capital position, Munich Re also raised its dividend by more than 30% and announced an expanded €2 billion share buyback program. Favorable market pricing and disciplined underwriting have continued to support profitability, even amid elevated volatility in capital markets and global catastrophe losses. Additionally, Munich Re’s experienced leadership team has placed an unusual emphasis on innovation for a reinsurer of its size, investing meaningfully in R&D and technology. For example, the company has identified, launched or already implemented over 300 AI use cases that aim to increase efficiency and enhance its competitive edge. We expect these initiatives to further support Munich Re’s continued market share gains across specialty lines, including cybersecurity, and in rapidly growing Asian markets where insurance penetration remains relatively low.

Sony, the global leader in video games, image sensors, music and movies, was a top contributor for the period. The company delivered strong quarterly results, driven primarily by its gaming and music businesses, and announced a new executive leadership structure. In gaming, Sony reported a record-high 129 million monthly active users, a 20% year-over-year increase in PlayStation Plus revenue and an expanding user base, as 40% of new PS5 console buyers were new to the platform. The Music segment also continued to benefit from global streaming tailwinds, delivering double-digit profit growth. In a significant leadership transition, Sony announced that, effective April 1, 2025, Hiroki Totoki, currently COO and CFO, would succeed Kenichiro Yoshida as CEO. Our original investment in Sony was grounded in the strategic transformation led by Yoshida-san, where Totoki-san was an instrumental partner in driving Sony’s pivot away from commoditized businesses whilespearheading investments in content IP and semiconductors. Looking ahead, we continue to see opportunity for Sony to capitalize on its unique position as both a content creator and platform owner. The company’s ability to integrate gaming, music, anime and film and leverage IP across platforms (e.g., Crunchyroll and its recent partnership with Kadokawa) should position it well for long-term value creation.

Recent Portfolio Activity

| Buys | Sells |

|---|---|

| Fast Retailing | Magna International |

During the quarter, we sold our position in Magna International and invested in Fast Retailing.

We first invested in Magna International, a Canada-based global auto parts, systems and assembly company, in the fourth quarter of 2019. The company, in our opinion, has a unique capability of supplying parts for an increasingly electrified and autonomous fleet of vehicles. This includes Magna’s specialty in lightweighting vehicles—a necessity for heavy electric cars—as well as its years of investment in self-driving technologies. In addition, with leading market share positions in many of its core markets and products, we believe Magna remains well-positioned to benefit as content-per-vehicle increases and automotive parts and systems become more complex. Though the company continues to meet our Quality and Valuation criteria, we have diminished confidence in its Catalysts. As such, we exited our position in Magna to fund the purchase of Fast Retailing, which we view as a more optimal investment.

Fast Retailing Co., Ltd.

Founded in 1984 and headquartered in Japan, Fast Retailing is one of the world’s largest apparel companies. Best known for its flagship brand UNIQLO, the company has over 3,500 stores worldwide, generating approximately 40% of sales in Japan, 20% in China and the remainder across the U.S., Europe and other Asian markets. UNIQLO (originally “Unique Clothing Warehouse”) accounts for roughly 85% of sales, with the remaining 15% coming from brands such as GU, Theory and others.

Fast Retailing is often grouped with “fast fashion” competitors such as Zara (owned by Inditex) and H&M. However, Fast Retailing’s strategy is fundamentally different. While fast fashion brands focus on rapidly turning over the latest trends—often at the expense of quality—Fast Retailing emphasizes timeless, high-quality apparel at accessible prices. Its LifeWear philosophy prioritizes functionality, comfort and durability, with innovations such as HeatTech for warmth and AIRism for breathability making its clothes essential wardrobe staples rather than disposable fashion. This focus on innovation, quality and affordability has helped Fast Retailing build a globally recognized brand with a history of profitable expansion in and outside Japan.

While this is our first time investing in Fast Retailing, we have followed the company for over a decade, having previously invested in Toray Industries, which produces many of the proprietary fabrics that underpin UNIQLO’s appeal. Given its long-term growth potential and operational strengths, we believe now is the right time to invest.

High-Quality Business

Some of the quality characteristics we have identified for Fast Retailing include:

- Economies of scale achieved with a strategy that focuses on functionality, quality and value (rather than rapidly changing fashion trends) contribute to above peer profitability;

- Globally recognized brand with a history of profitable expansion within Japan and internationally;

- Technology-driven innovation in materials, inventory, logistics and supply chain management; and

- Long-tenured management team with unusually high insider ownership.

Attractive Valuation

Based on our estimates, shares of the company are attractively valued. We believe continued overseas expansion, as well as other catalysts (see below), will likely lead to higher normalized margins and FREE cash flow than currently appreciated by the market.

Catalysts

Catalysts we have identified for Fast Retailing, which we believe will cause its stock price to appreciate over our three- to five-year investment horizon, include:

- Continued overseas expansion should drive higher normalized revenue and profitability;

- Operational improvements in China, including better inventory management and an optimized store footprint, are expected to enhance margins; and

- Improved performance at GU brand in Asia, as well as expansion into the U.S.

Conclusion

As we progress through the early stages of 2025, the convergence of persistent macroeconomic forces with the renewed presence of trade conflicts has added to the uncertainty facing equity markets. While there certainly was no shortage of headlines during the quarter, we believe trying to time the market or to predict the impact of these developments is a futile task. Instead, our focus remains on evaluating whether these events are truly analyzable, materially differentiated and meaningful to long-term investors—or simply noise that fuels short-term speculation.

At Aristotle Capital, we do not aim to capture short-term gains by “trading” portfolios based on the news of the day. Rather, we remain committed to identifying companies we believe exhibit high-quality characteristics and the resilience to perform across full market cycles. In our experience, breaking news is often fleeting and not quite as impactful as many market participants believe it to be. On the contrary, during periods of economic uncertainty high-quality companies are oftentimes able to make decisions that result in market share gains, thus, potentially, increasing their longer-term intrinsic worth. As such, we will continue to study the microeconomic decisions of individual businesses rather than attempt to predict macroeconomic events or outcomes.

The opinions expressed herein are those of Aristotle Capital Management, LLC (Aristotle Capital) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to buy or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Capital makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle International Equity ADR strategy. Not every client’s account will have these characteristics. Aristotle Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Capital’s International Equity ADR Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Capital does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Capital Management, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Capital, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACM-2504-102

Sources: CAPS CompositeHubTM, MSCI

Composite returns for all periods ended March 31, 2025 are preliminary pending final account reconciliation.

Past performance is not indicative of future results. The information provided should not be considered financial advice or a recommendation to purchase or sell any particular security or product. Performance results for periods greater than one year have been annualized.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The MSCI ACWI captures large and mid-cap representation across 23 developed market countries and 24 emerging markets countries. With approximately 2,600 constituents, the Index covers approximately 85% of the global investable equity opportunity set. The MSCI ACWI Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 developed markets countries (excluding the United States) and 24 emerging markets countries. With approximately 2,000 constituents, the Index covers approximately 85% of the global equity opportunity set outside the United States. The MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 24 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Brent Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. The MSCI Japan Index is designed to measure the performance of the large and mid-cap segments of the Japanese market. With approximately 200 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in Japan. The Bloomberg Global Aggregate Bond Index is a flagship measure of global investment grade debt from 27 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The MSCI United Kingdom Index is designed to measure the performance of the large and mid-cap segments of the U.K. market. With nearly 100 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in the United Kingdom. The MSCI Europe Index captures large and mid-cap representation across 15 developed markets countries in Europe. With approximately 400 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization across the European developed markets equity universe. These indexes have been selected as the benchmarks and are used for comparison purposes only. The volatility (beta) of the Composite may be greater or less than the respective benchmarks. It is not possible to invest directly in these indexes.

Sources: CAPS CompositeHubTM

Sources: CAPS CompositeHubTM

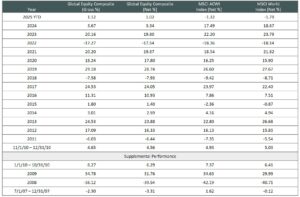

Composite returns for all periods ended March 31, 2025 are preliminary pending final account reconciliation. MSCI ACWI (Net) was stated as the primary benchmark on June 1, 2024 and MSCI World (Net) became the secondary benchmark. The Aristotle Global Equity Composite has an inception date of November 1, 2010; however, the strategy initially began at Howard Gleicher’s predecessor firm in July 2007. A supplemental performance track record from January 1, 2008 through October 31, 2010 is provided on this page and complements the Global Equity Composite presentation that is located at the end of this presentation. The performance results were achieved while Mr. Gleicher managed the strategy at a prior firm. The returns are those of a publicly available mutual fund from the fund’s inception through Mr. Gleicher’s departure from the firm. During that time, Mr. Gleicher had primary responsibility for managing the fund.

Composite returns for all periods ended March 31, 2025 are preliminary pending final account reconciliation. MSCI ACWI (Net) was stated as the primary benchmark on June 1, 2024 and MSCI World (Net) became the secondary benchmark. The Aristotle Global Equity Composite has an inception date of November 1, 2010; however, the strategy initially began at Howard Gleicher’s predecessor firm in July 2007. A supplemental performance track record from January 1, 2008 through October 31, 2010 is provided on this page and complements the Global Equity Composite presentation that is located at the end of this presentation. The performance results were achieved while Mr. Gleicher managed the strategy at a prior firm. The returns are those of a publicly available mutual fund from the fund’s inception through Mr. Gleicher’s departure from the firm. During that time, Mr. Gleicher had primary responsibility for managing the fund.

Sources: CAPS CompositeHubTM

Sources: CAPS CompositeHubTM

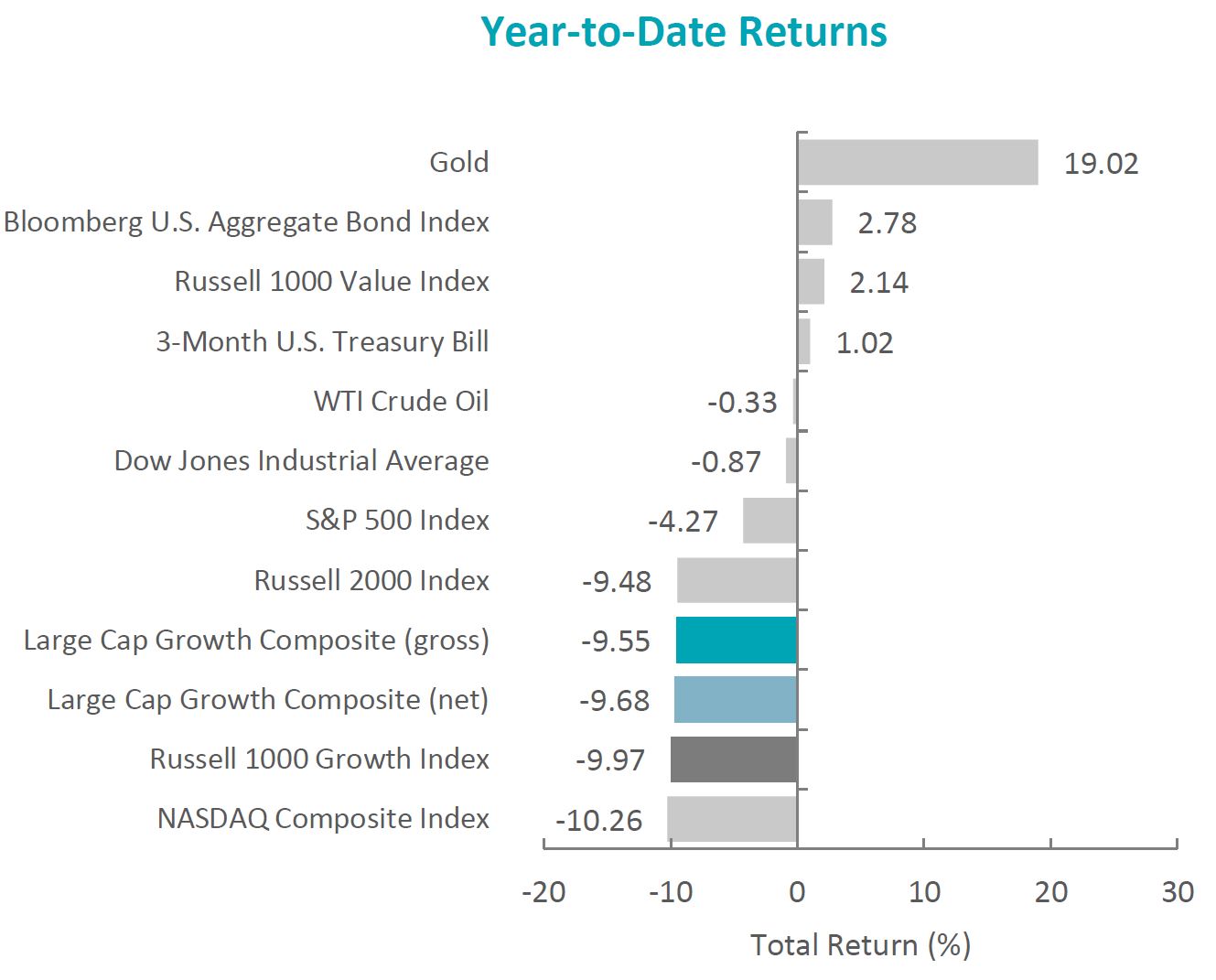

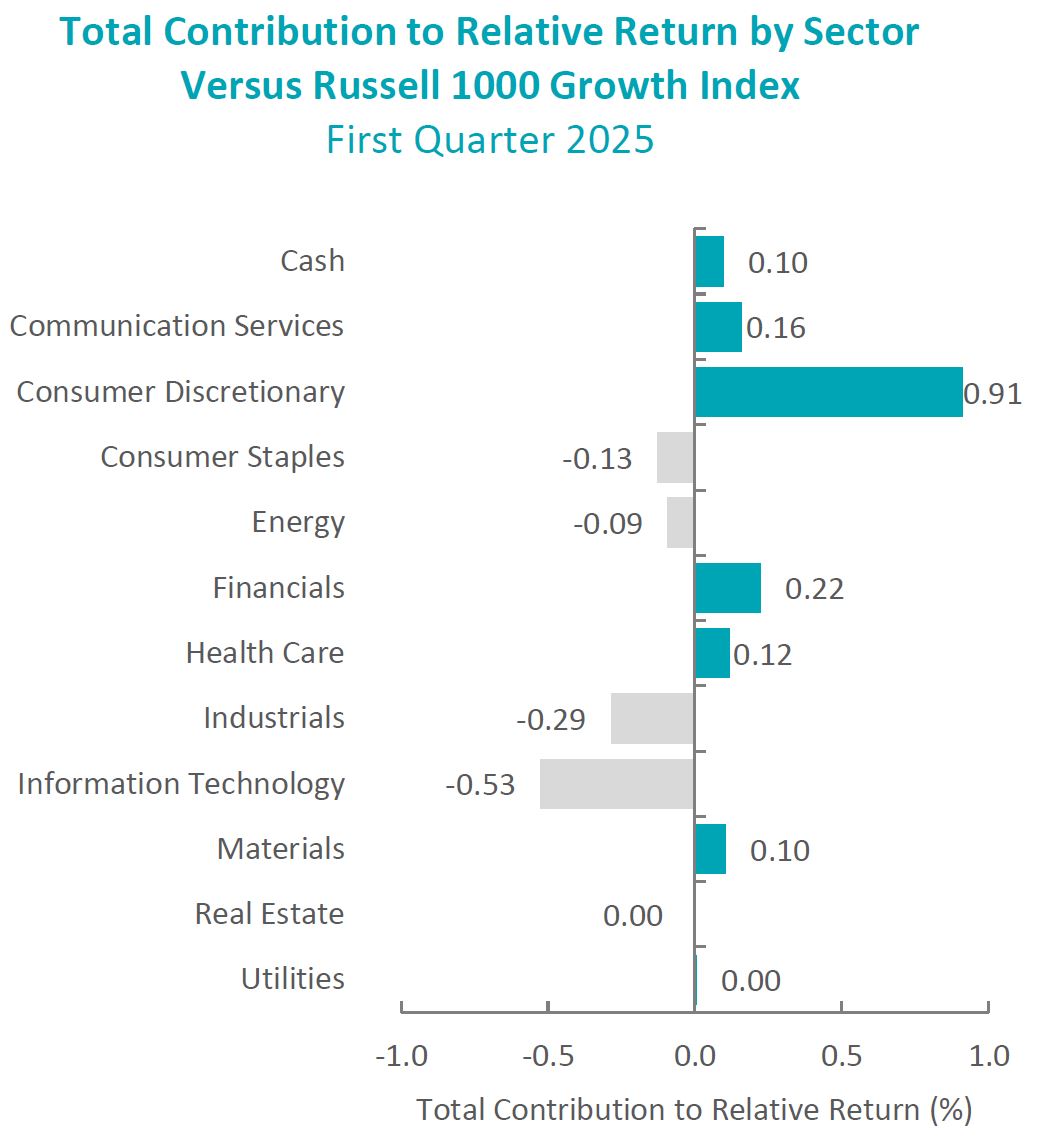

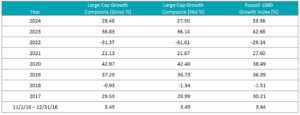

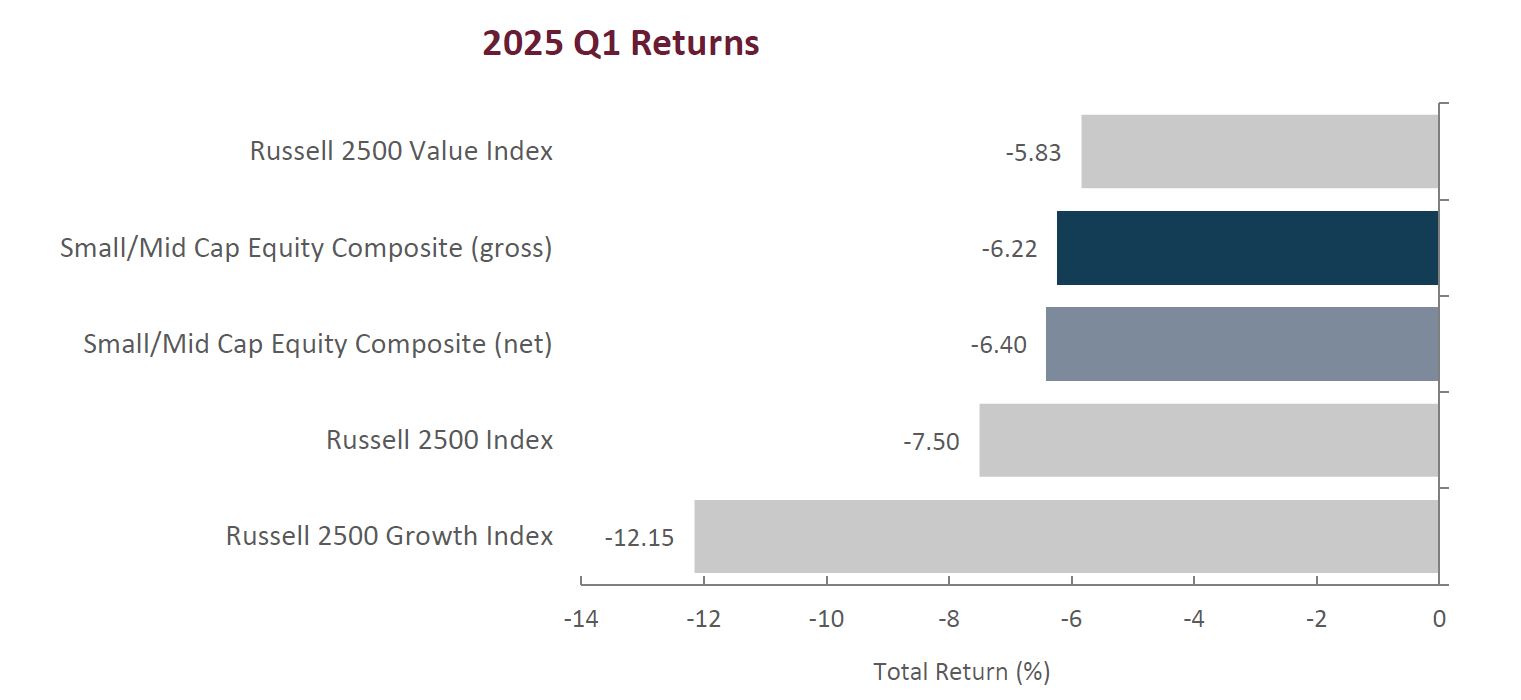

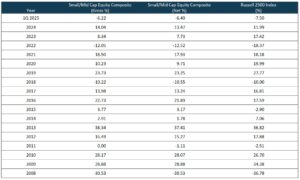

Sources: CAPS Composite Hub, Russell Investments

Sources: CAPS Composite Hub, Russell Investments

Sources: CAPS Composite Hub, Russell Investments

Sources: CAPS Composite Hub, Russell Investments

Composite returns for all periods ended March 31, 2025 are preliminary pending final account reconciliation.

Composite returns for all periods ended March 31, 2025 are preliminary pending final account reconciliation.

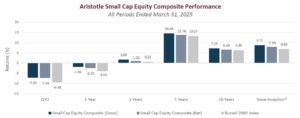

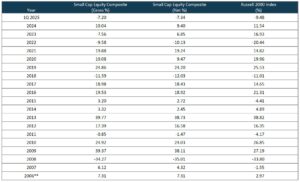

Sources: CAPS Composite Hub

Sources: CAPS Composite Hub